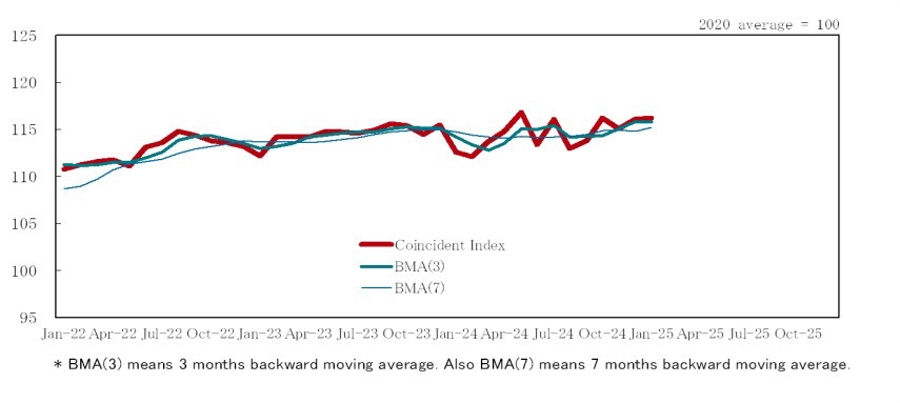

- Coincident index 116.2

- Prior 116.1

It's a marginal bump relative to the readings in December with the assessment of the coincident index remaining unchanged, deemed as "halting to fall".

It's a marginal bump relative to the readings in December with the assessment of the coincident index remaining unchanged, deemed as "halting to fall".

Most Popular

Bitcoin tests $60K support, down 16% weekly, as tech selloff triggers risk-off; Ether dumps 17%.

Bitcoin ETFs see only 6.6% outflows despite 40%+ drop; ETF holders' resilience contrasts with crypto natives' panic.

US job openings hit 5-yr low (6.5M), signaling labor market slowdown. Traders eye Fed policy shifts.

BOJ’s Masu said Japan is now in inflation and policy will keep normalising if the outlook holds, but hikes will be cautious to protect the wage–price cycle; JGB purchases are being tapered sharply.

AI tool's impact sends software stocks tumbling 10% as traders fear disruption. Valuation concerns rise.

WGC data show gold ETFs drew a record US$19bn in January, lifting AUM to US$669bn and holdings to 4,145t. Most regions saw late-month dip-buying as prices pulled back.

Bitcoin plunges to $60K, down 50%+ in 4 months! Retail traders caught in the rout as risky assets dump.

Must Read