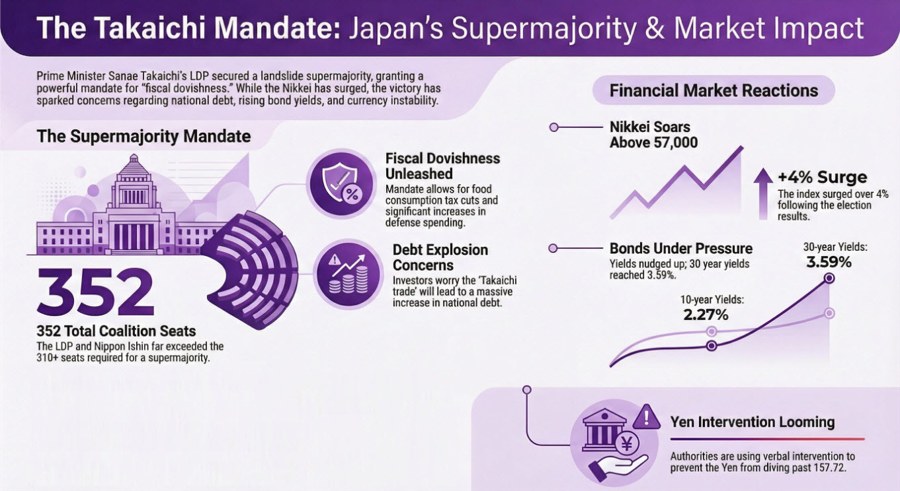

The ruling Liberal Democratic Party (LDP) punched above their weight and the results were one-sided, with the opposition losing roughly half of their pre-election standing. The LDP claimed 316 seats with their coalition partner Nippon Ishin claiming 36 seats, far exceeding the two-thirds (310+) needed for a 'supermajority'.

It's a landslide victory for Japan prime minister Takaichi, as her gambit to consolidate power and strengthen her position pays off.

That just reinforces the Takaichi trade that has been running since October last year, with concerns now that national debt will explode. She wants to push for a consumption tax cuts, particularly on food, with focus on defense spending as well. And now with such a powerful mandate, it'll be impossible to stop her fiscal dovishness.

Fast forward to today, we're now seeing Tokyo authorities switch to damage control mode. That as long-term yields nudge up while the yen currency looked like it was about to take another dive. Quite frankly, it's a bit baffling that they waited until today to try and do that when the writing was on the wall since last week.

In any case, some verbal intervention has helped to limit the damage towards the yen currency at least. USD/JPY is down 0.4% to 156.63 after touching a high of 157.72 earlier in the day. The 100-hour moving average is being held right now around 156.56, as buyers remain cautious.

Meanwhile, 10-year Japanese government bond yields are up some 5 bps to 2.27% while 30-year yields are flattish around 3.56% after climbing to 3.59% earlier. The Bank of Japan (BOJ) did warn in their latest meeting that they will be taking action in the bond market, so perhaps that is limiting the selloff here.

The big winner is the Nikkei as it soared to over 57,000 earlier and is still up over 4% after the lunch break now at 56,541.

Now that we're definitely going to be sticking with the Takaichi trade, the question of actual intervention in the FX market looks to be a matter of when rather than if. But amid a lack of change in fundamental drivers, just be wary that any intervention may only be temporary as we've seen with previous episodes.

The most recent was back in July 2024 when intervention brought USD/JPY down from over 160 to the 140 mark. But within six months, the currency pair rebounded strongly back to 159 amid the unchanged macro backdrop at the time.