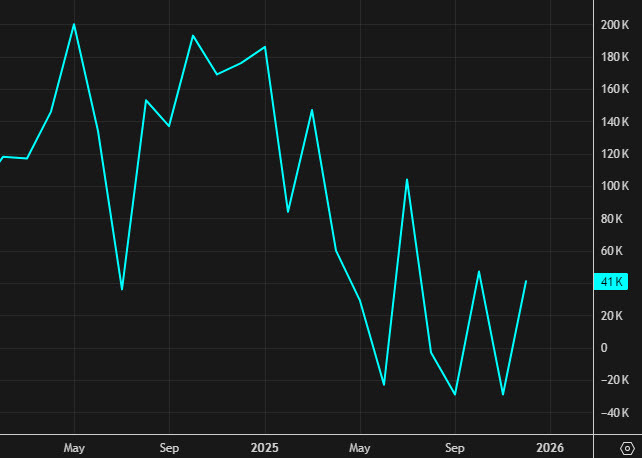

- Prior was +41K (revised to +37K)

- Goods +1K versus -3K last month

- Service +21K versus +44K last month

- small business 0K vs +9K prior

- medium businesses +41K vs +34K last month

- large businesses -18K vs +2K last month

- Wages for job stayers 4.5% vs 4.4% last month

- Wages for job changers 6.4% vs 6.6% last month

Sector changes.

- Education and health +74K vs +39K prior

- Leisure hospitality +4K vs +24K prior

- Construction +9K

- Financial activities +14K vs +6K prior

- Professional business services -57K vs- 29K prior

That's a grim breakdown with all kinds of white collar job losses and all the net employment going to government-adjacent fields.

“Job creation took a step back in 2025, with private employers adding 398,000 jobs, down from 771,000 in 2024,” said Nela Richardson, chief economist, ADP. “While we've seen a continuous and dramatic slowdown in job creation for the past three years, wage growth has remained stable.”

Notably, ADP removed 212K jobs from the 2025 rolls in a benchmark revision.

For background, the ADP National Employment Report is an independent monthly measure of private-sector employment in the United States, produced by ADP Research in collaboration with the Stanford Digital Economy Lab. Based on anonymized payroll data from more than 26 million employees across over half a million companies, the report provides a high-frequency view of labor market trends and is typically released on the first Wednesday of each month, two days before the official Bureau of Labor Statistics jobs report.

The report tracks changes in private-sector employment by industry, company size, and geographic region, alongside insights into wage growth for both job-stayers and job-changers. In October 2025, private employers added 42,000 jobs following a revised 29,000 job loss in September, with growth concentrated among large establishments. However, November marked a sharp reversal, as private businesses cut 32,000 jobs, the biggest decline since March 2023, led by substantial losses among small establishments. December brought a modest recovery, with private employers adding 41,000 jobs, driven primarily by education, health services, and leisure/hospitality sectors. Throughout this period, annual pay growth for job-stayers held steady around 4.4-4.5%, reflecting a moderating wage environment.