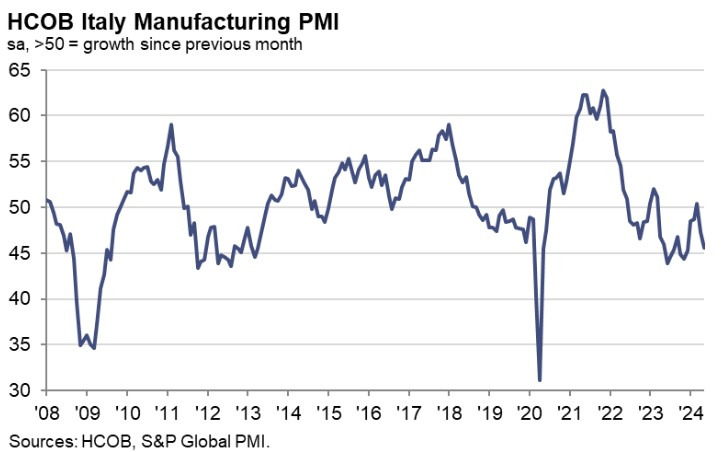

- Final Manufacturing PMI 45.6 vs.48.0 expected and 47.3 prior.

Key findings:

- Operating conditions deteriorate at most pronounced rate in 2024 so far.

- Confidence dips following order book slump.

- Firms cut charges despite rising costs in an attempt to drum up sales.

Comment:

Commenting on the PMI data, Dr Tariq Kamal Chaudhry Economist at Hamburg Commercial Bank, said:

“The goods-producing sector in Italy continued to struggle in May. The HCOB PMI for the manufacturing sector has declined further from the previous month, currently standing at 45.6. This weakness appears to be widespread, affecting nearly all sub-indices."

“Manufacturers were plagued by inflation. While overall producer price inflation in Italy seems under control, the HCOB PMI suggests upside risk. In May, input prices surged significantly and to the dismay of businesses, output prices dropped. This means companies didn’t pass the higher costs onto consumers."

“The Italian industry is in bad shape again. Despite skilled labour shortages, factory layoffs returned in May. Anecdotal evidence indicates that the decline in employment reflects a combination of retirements, layoffs, and non-renewal of contracts. This also signals some uncertainty towards the future outlook if more manufacturers are preparing for worse times."

“Domestic and foreign orders are shrinking significantly once again. Survey participants cited reasons ranging from challenging domestic market conditions to weakening demand across Europe and geopolitical uncertainties. Despite this, it is remarkable that Italian manufacturing companies’ view towards future output exceeds the historical average. It remains to be seen how long this optimism will last.”