- Prior 52.1

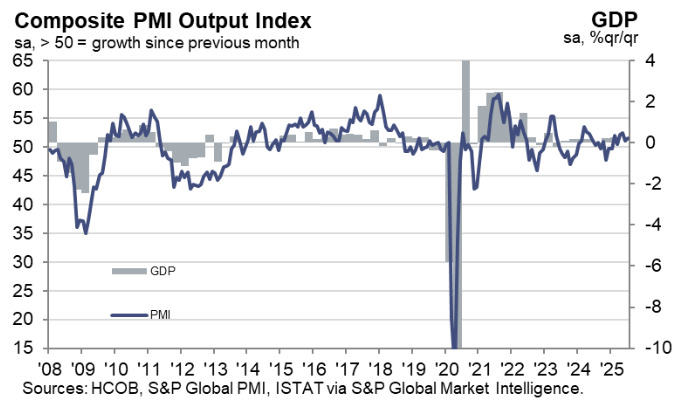

- Composite PMI 51.5 vs 51.1 prior

Key findings:

- Activity rises at modest pace

- Overall new business remained propped up by domestic demand

- Future outlook brightens, but jobs growth slows

Comment:

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“Italy’s services sector extended its growth streak into July, with the headline HCOB Services PMI inching up to 52.3 from 52.1 in June. This modest acceleration reflects a sector that remains resilient, underpinned by steady domestic demand and a cautiously improving outlook. Business activity rose for the eighth consecutive month, with surveyed firms reporting new client wins and the launch of fresh projects. However, the pace of new business growth softened to its weakest in six months, suggesting that while the recovery continues, it is becoming more measured.

“The divergence between domestic and international demand persisted. While local sales held firm, new export business declined for the twelfth straight month, reflecting ongoing fragility in global demand. Nonetheless, the rate of contraction in foreign orders eased slightly, hinting at a possible bottoming out. Employment growth, though still above the historical average, lost some momentum as firms focused on filling existing vacancies rather than expanding headcount aggressively.

“On the price front, input cost inflation cooled to its lowest level since November 2024, despite continued upward pressure from wages, fuel and services. This easing in cost pressures gave firms some breathing room. Meanwhile, output prices rose at the fastest pace in over a year. The move suggests a renewed effort to defend margins, even as consumer price sensitivity remains a concern.

“The July PMI data arrives alongside a disappointing Q2 GDP print, with Italy’s economy contracting by 0.1% quarter-on- quarter, against expectations of a modest expansion. While services remain a source of relative strength, the manufacturing PMI stayed in contraction territory. Taken together, the data point to a fragile growth environment heading into the second half of the year.”