- Prior 51.5

- Composite PMI 51.4 vs 50.3 prior

Key findings:

- Stronger growth in output, but softer rise in inflows of new business

- Outlook dims with hiring activity slowing

- Cost pressures cool but charge inflation picks up

Comment:

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

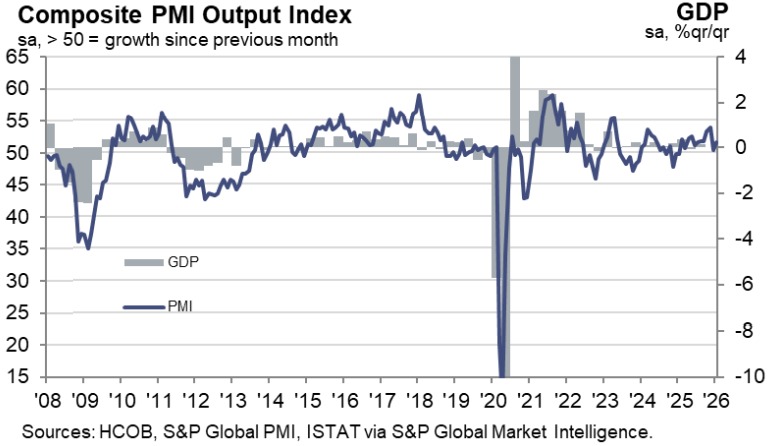

“The Italian services economy entered 2026 on a firmer footing, with the HCOB Italy Services PMI rising to 52.9 in January from 51.5 in December. The pick‑up in activity moved the headline index back above its historical trend and extended the current growth sequence to fourteen months. Firms reported healthy levels of client onboarding and new public tender wins, despite a moderation in total new business growth and another marginal decline in export sales. While still solid by historical standards, the slowdown in new inflows signals that demand dynamics have become slightly less supportive at the start of the year.

“Employment continued to expand in January, with firms hiring across a range of operational and specialist roles. However, the pace of job creation remained only slight as companies increasingly showed caution around additional spending. Backlogs of work fell marginally again, suggesting that capacity is broadly aligned with current workloads.

“Price developments were mixed. Input cost inflation eased to its weakest rate in three months, even as staffing and energy expenses continued to rise. Output charge inflation, however, accelerated to a six‑month high as firms passed through these cost burdens more decisively.

“Business expectations deteriorated for a second month running and slipped to a five‑month low. Although firms remain optimistic overall, expectations are now well below the historical average, held back by concerns over competitive pressures and subdued economic prospects. This downshift in confidence is also consistent with the latest international growth projections. According to the IMF, Italy is set to grow by only 0.7 percent in 2026, broadly in line with other forecasts yet notably lower than the euro area’s expected 1.3 percent, indicating that economic momentum may remain comparatively restrained.”