- Services PMI 50.4 vs. 50.5 expected and 50.7 prior.

- Composite PMI 49.7 vs. 49.7 prior.

Key findings:

- Fractional rise in business activity amid marginal drop in new business

- Renewed decrease in employment levels

- Rate of both cost and charge inflation rise to nine-month highs

Comment:

Commenting on the final PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

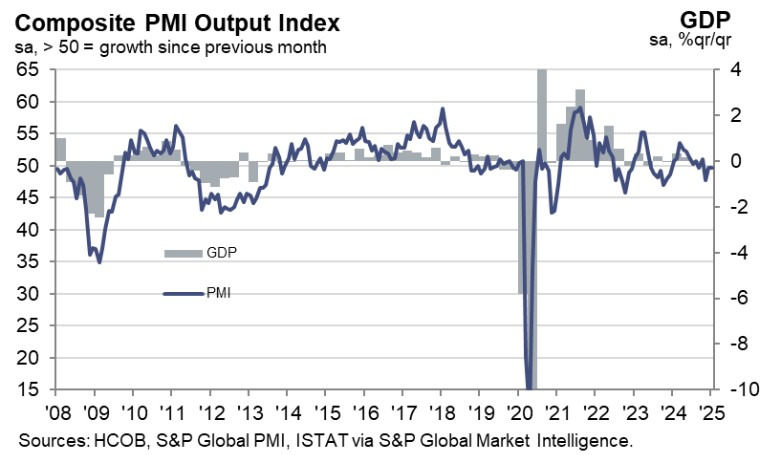

“Another GDP standstill in the final quarter, following stagnation in the third quarter, highlights Italy’s sluggish economic development in the second half of 2024. This trend aligns with the HCOB composite Output PMI, which averaged 49.9 from July to December 2024. With 50 marking the threshold between growth and decline, the PMI data accurately reflects the GDP figures. The latest HCOB PMI release for Italy’s private sector economy signals that sluggishness is here to stay. The Composite Output Index posted minimally in contraction territory, continuing the recent trend of decline.

“Activity in the Italian service sector remains within the growth area, but only marginally. Underlying demand remains weak and has worsened again, as new orders declined both at the total level and from foreign clients. Panellists report that uncertainty and weak economic conditions abroad are limiting demand. This weakened demand is translating into further decreases in of outstanding business. This bleak picture leaves future expectations of service providers below the long-term average, as indicated by the HCOB PMI data.

“Service input price inflation could become a more significant concern. Input price inflation is accelerating and has reached an elevated level, raising alarm bells. Companies are passing on these raised input costs, with wages still playing a key role, to customers by increasing their sales prices, as reflected in the data. In the latest ECB meeting, Lagarde stated confidence that wage increases across the service sector are on their way down. However, she won’t be pleased with the latest PMI price data.”