- Prior 47.9

Key findings:

- Softer falls in output and total new orders

- Outlook brightens as employment rises for first time in four months

- Charge inflation returns as cost burdens rise at fastest rate in over three years

Comment:

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

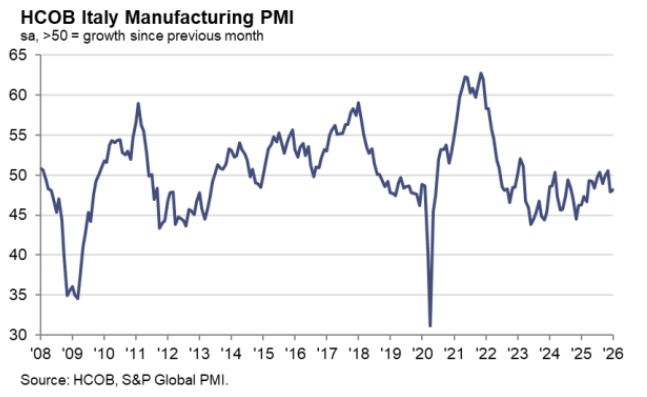

“Italian manufacturing began 2026 still in contraction, yet January’s survey data offered tentative signs that the sector may be edging toward firmer ground. The headline index rose slightly to 48.1 from 47.9, marking a second month below the 50 threshold but signalling a slower pace of decline. The softer falls in both output and new orders suggest that the intense weakness seen late last year may be easing. Even so, demand remains fragile at home and abroad, with firms reporting cancellations and difficult market conditions. Export orders, excluding brief upticks in May and November 2025, continued their nearly three-year downtrend, though the latest fall was modest.

“One of the most striking developments in January was the further intensification of cost pressures. Input prices rose at the fastest pace in more than three years, driven by broad-based increases across key raw materials including metals and wood. This pick-up in cost inflation fed through to selling prices, which climbed for the second time in three months. For now, charge inflation remains mild compared with input costs, but the shift back into price-raising territory points to the return of margin pressures.

“In line with weaker order flows, firms scaled back their purchasing activity at a faster pace, contributing to slimmer input inventories. At the same time, there were signs of stabilisation in supply chains, with delivery times shortening for the first time since mid-2025. Employment provided a rare bright spot, rising for the first time in four months as firms hired mainly permanent staff, reflecting firmer expectations for the year ahead. This improved mood was also evident in the broader outlook, with business expectations strengthening markedly and reaching one of the highest levels in nearly four-and-a-half years, supported by expectations of sectoral recovery, borrowing cost cuts and new product initiatives.”