- Prior 52.3

- Composite PMI 51.7 vs 51.5 prior

Key findings:

- Cost pressures intensify, but charge inflation cools

- Output expectations among the weakest in over four-and-a-half years

Comment:

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

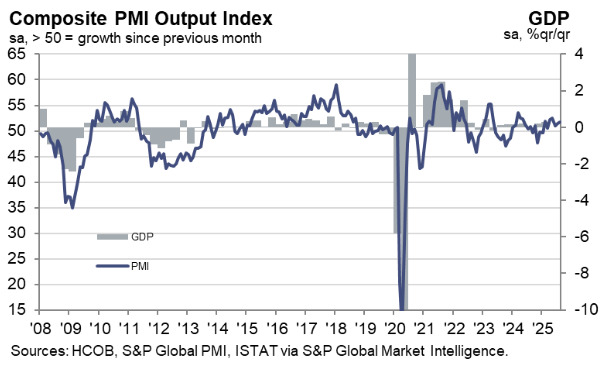

“Italy’s services sector lost momentum in August, with the HCOB Services PMI slipping to 51.5 from 52.3 in July – its lowest reading since January. While the sector remained in expansion territory for a ninth consecutive month, the pace of growth was modest and subdued by historical standards. This slowdown came despite a solid uptick in new business, which firms attributed to new client wins and improved domestic demand. However, the divergence between domestic and foreign sales persisted, as export business contracted for the thirteenth straight month, albeit at a slower pace.

“Employment growth continued but slowed again, reflecting a more cautious hiring stance. Backlogs of work declined for the sixth month in a row, which suggests that current staffing levels may be sufficient to meet demand. Cost pressures intensified, with firms reporting higher expenses for fuel, energy, rent and other business inputs. At the same time, service providers moderated their output price increases to the weakest rate in nine months, indicating margin compression.

“Business confidence deteriorated, as firms’ expectations for the year ahead sank to one of the lowest levels recorded in over four-and-a-half years. While some firms remained optimistic that new projects and client acquisitions would support future growth, sentiment was broadly weighed down by muted economic conditions.

“The broader picture across Italy’s private sector was slightly more encouraging: the HCOB Composite PMI edged up to 51.7. This improvement was driven by renewed growth in manufacturing output, which helped offset the softer services expansion. New business growth at the composite level accelerated to its strongest pace in 16 months, suggesting that underlying demand across Italy’s private sector is becoming increasingly robust.”