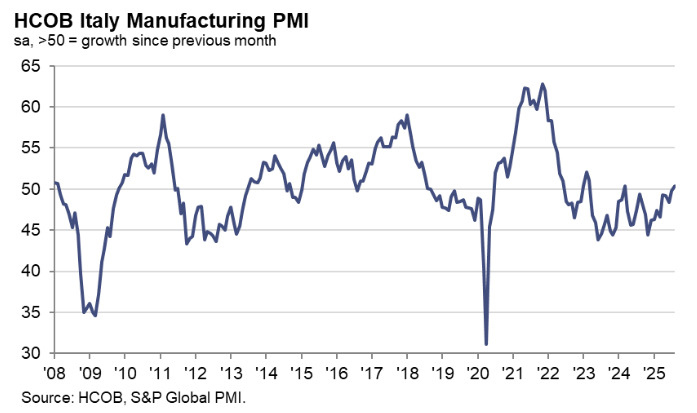

- Prior was 49.8

Key findings:

- Sharpest increase in production volumes in nearly two-and-a-half years

- Slight rise in overall order books despite sustained drop in export sales

- Input and output prices fall marginally

Comment:

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“After nearly one-and-a-half years of contraction, Italy’s manufacturing sector finally edged back into growth territory in August, with the headline HCOB PMI climbing to 50.4. This improvement was driven by a sharp rebound in output, which rose at the fastest pace since early 2023, and a slight increase in new orders.

“While the expansion in new orders was modest, it marked a turning point for domestic sales, which had been under pressure for several quarters. New export orders, however, declined again, extending a near two-and-a-half-year trend of contraction (excluding May’s slight uptick), as firms continued to cite trade and geopolitical tensions as key headwinds. With output growth outpacing new orders, backlogs of work fell sharply, prompting firms to trim employment further. Although the reduction in headcounts was marginal, it coincided with a notable dip in business confidence to a four-month low, underscoring the subdued confidence among manufacturers.

“Inventory and purchasing trends also reflected this restraint. Input purchases declined again, and firms drew down pre- production inventories at the fastest rate seen this year. Supplier delivery times worsened again, despite subdued demand, suggesting persistent inefficiencies in supply chains. Input costs fell slightly, supported by lower energy prices and favourable exchange rate movements. Output charges also declined, although the rate of discounting was modest.

“Overall, August’s data point to a fragile recovery in Italy’s manufacturing sector. While the headline PMI signals expansion, underlying indicators suggest that firms remain cautious, awaiting clearer signs of sustained demand.”