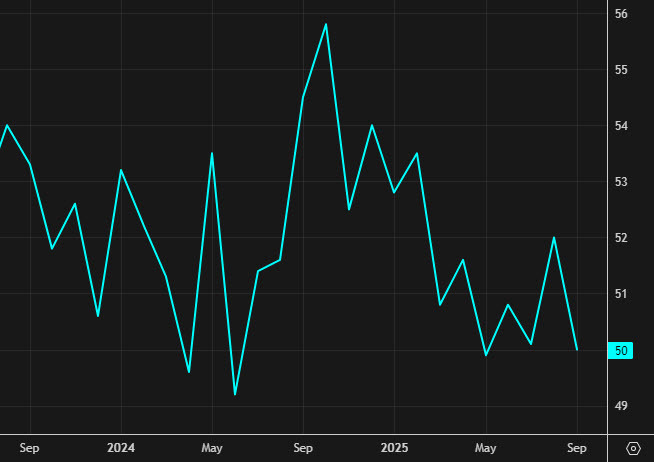

- Eight month high

- Prior was 50.0

Details:

- Business activity 54.3 vs 49.9 prior

- Prices paid 70.0 vs. 69.4 last month -- three year high

- Employment 48.2 vs. 47.2 last month

- New orders 56.2 vs. 50.4 last month -- highest since Oct 2024

- Supplier deliveries 50.8 vs. 52.6 last month

- Inventories 49.5 vs. 47.8 last month

- Backlog of orders 40.8 vs. 47.3 last month

- Exports 46.5 vs. 46.5 last month

- Imports 49.2 vs. 49.2last month

This doesn't look like data that argues for cutting rates in December. Prices has ticked down slightly but is still above 60%.

ISM services

Comments in the report:

- “Activity is generally flat month-over-month; we are closely monitoring effects of the new tariff announcement.” [Finance & Insurance]

- “Uncertainty due to the federal government shutdown has shuttered many non-essential functions. This will lead to project delays and likely hurt our overall fiscal year 2026 expectations. Our sites are funded through the next couple of months, but if the shutdown continues beyond that time, we will expect mass furloughs of our employees.” [Management of Companies & Support Services]

- “Relatively flat activity levels for oil and gas.” [Mining]

- “Client demand for advisory and compliance services remains solid, particularly as businesses navigate evolving tax legislation and increased regulatory scrutiny. However, we are seeing extended approval cycles on discretionary projects and tighter controls on consulting spend, which is putting pressure on procurement to be more agile and cost-efficient.” [Professional, Scientific & Technical Services]

- “Heightened business activity due to new fiscal year budget. Items made with or utilizing precious metals are up, basic labor is down — though maintaining employees has been more difficult since a return-to-office order was implemented.” [Public Administration]

- “The overall economy continues to provide mixed signals, which makes it difficult to determine how to move forward as a business given the uncertainty.” [Real Estate, Rental & Leasing]

- “Business very strong, no supply chain or logistical issues.” [Retail Trade]

- “General business has been steady, with minimum fluctuation.” [Transportation & Warehousing]

- “Tariffs continue to cause disruption in contracts and contracting, driving up pricing on goods, particularly engineered and manufactured equipment. The backlog of existing orders with delays continues to persist for equipment and manufactured equipment.” [Utilities]

- “Business seems to be picking up. Multifamily is a big driver. I think most projects that have been postponed are finally coming to fruition as lumber prices have found a bottom. The outlook is better with the Fed’s plan to continue with rate cuts. Home prices coupled with elevated interest rates continue to keep a lid on sales. Home affordability is still a bit out of reach for a large portion of potential buyers. [Wholesale Trade]