Headlines:

- US equities look to recover a little after a rough few days

- How have interest rate expectations changed after this week's events?

- Oil prices in the spotlight as focus remains on US-Iran negotiations in Oman

- ECB policymakers repeat policy is in "good place"; ease tone on euro's strength

- BOJ policymaker Masu says not thinking of a particular pace in hiking interest rates

- Germany December industrial production -1.9% vs -0.3% m/m expected

- French trade deficit narrows further in 2025 as exports rebound

- UK January Halifax house price index +0.7% vs -0.6% m/m prior

Markets:

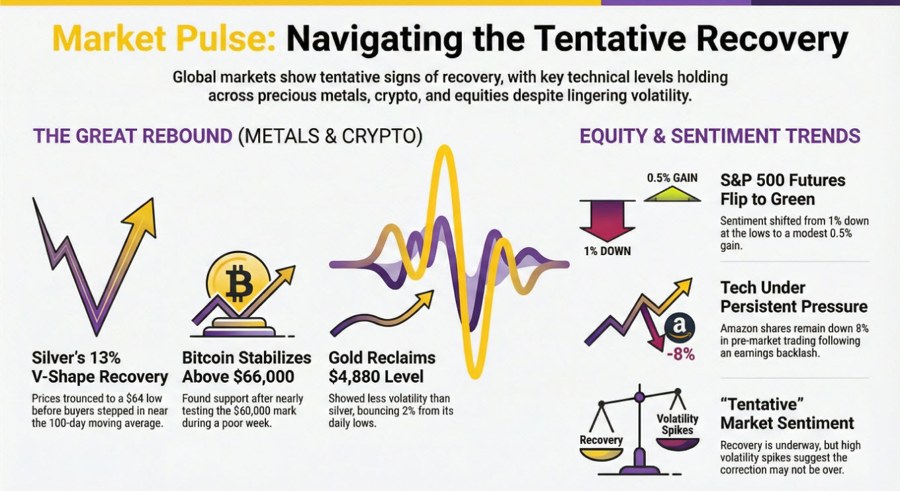

- Precious metals bounce back, US futures cover early losses, Bitcoin rebounds

- Silver up 4.1% to $74.18 after the low in early Asia hit near $64

- Gold up 2.3% to $4,882 in less volatile trading

- S&P 500 futures up 0.5% as tech shares bounce back, Amazon down 8% in pre-market though

- Bitcoin up over 5% to above $66,000 after coming close to test $60,000 mark

- US dollar steady and more mixed across the board, commodity currencies lead on risk recovery

- WTI crude oil flat at $63.16 as US-Iran talks continue

It was a calmer session in Europe today as broader market sentiment shows some tentative signs of recovery. Key word there being tentative of course. That after a rough few days for risk trades especially, amid a painful combination of selling in precious metals, tech stocks, and cryptocurrencies.

Today, all three are showing a modest bounce but not without some early drama in early Asia trading before this.

Silver got trounced once again in falling over 13% to near $64 before recovering to be up 4% now just above the $74 level. Gold was less volatile as it fell to a low of $4,655 before bouncing back over 2% now to $4,882 on the day.

The dramatic bounce highlights that the volatility spikes are still very much in play but reaffirms a continued healthy correction for precious metals. Of note, the rebound in silver comes as dip buyers stepped in with price having moved within touching distance of the 100-day moving average - a key technical level on the charts.

Overall risk sentiment also caught a modest rebound with S&P 500 futures now seen up 0.5%. At the lows earlier, futures were down 1% as tech shares stayed under pressure. Amazon's earnings backlash did not help with shares still down 8% in pre-market, but at least there's a broader recovery elsewhere.

The mood music is helped by a rebound in Bitcoin after the cryptocurrency came within a whisker of testing the $60,000 mark. That saw bids come in with Bitcoin now rising back up above $66,000 to stabilise a little after a very poor week.

In other markets, things were less dramatic with the dollar holding steadier and slightly softer at the balance against the rest of the major currencies. EUR/USD keeps just below the 1.1800 level amid large option expiries and some ECB commentary on the exchange rate.

Meanwhile, USD/JPY is flat holding just above the 157.00 level while commodity currencies lead gains with AUD/USD up 0.8% to 0.6980 levels on the day.

Besides that, oil prices also continues to be in focus in awaiting US-Iran talks in Oman. For now, the mood is tense but oil is still set for a weekly drop with price at $63.16 currently.