Headlines:

- Precious metals bounce back to trim losses on the day

- Has the bull market in gold ended? History suggests yes

- European stocks turn things around after a rough start to the new week

- USD/JPY inches up to start the day after Takaichi kerfuffle

- What's at stake now as the US partial shutdown drags to at least Tuesday?

- RBA preview: Ignore the rate hike and focus on the forward guidance

- Germany December retail sales +0.1% vs +0.2% m/m expected

- Eurozone January final manufacturing PMI 49.5 vs 49.4 prelim

- UK January final manufacturing PMI 51.8 vs 51.6 prelim

- UK January Nationwide house prices +0.3% vs +0.3% m/m expected

Markets:

- Gold down 2% to $4,792 but well off 10% drop earlier

- Silver down 1.8% to $83.68 but well off 16% drop earlier

- S&P 500 futures -0.3%, Nasdaq futures -0.6%; Nvidia pulls OpenAI investment

- European equities higher after weak start, DAX +0.9%

- USD leads, CHF lags on the day

- WTI crude oil down 5.3% to $62.23

- US 10-year yields down 1 bps to 4.231%

- Bitcoin up 1.2% to $77,855 after brief drop under $75,000 earlier

It's quite the exciting start to the week, even if it is not as dramatic as how we ended January trading on Friday last week.

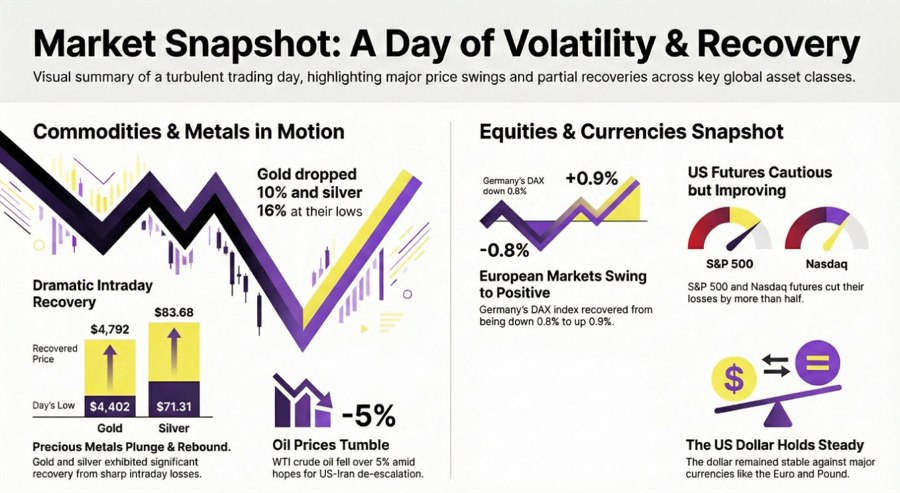

Precious metals were once again in the spotlight as the volatile selling continued towards the tail end of Asia trading. Gold dropped by 10% at one point with silver down roughly 16% at the lows before a modest recovery in European morning trade.

Both gold and silver have now trimmed declines to roughly 2% only with the former at $4,792 and latter at $83.68 on the day. For some context, the lows for the day for both were at $4,402 and $71.31 respectively. So, that paints a better picture of the bounce we're seeing on the session.

As the focus stays on the pullback/correction in precious metals, the dollar continues to find itself in a steadier position. EUR/USD is trading little changed at 1.1848 amid a tighter range with GBP/USD likewise at 1.3686 on the day.

Meanwhile, USD/JPY remains underpinned after a bit of a kerfuffle from Japan prime minister Takaichi over the weekend. The currency pair is up 0.1% just under the 155.00 level after Takaichi delivered a positive bias for a weaker yen before trying to walk back on her comments after.

In the equities space, things got off to a rough start with European indices opening lower but recovering that and then some as the market turbulence eased during the session. To put things into perspective, the DAX was down around 0.8% early on but recovered well to be up 0.9% instead now.

As for US futures, the mood music remains more cautious. Tech shares are still lagging amid AI concerns, that especially after Nvidia pulled investment on OpenAI. That could really open a can of worms and have a domino effect on the space, so just be wary of that.

S&P 500 futures are still down 0.3% but at least well off earlier lows of around 1.1%. Nasdaq futures are the same as well, down 0.6% now after being lower by as much at 1.5% earlier in the day.

Elsewhere, we're seeing a big move in the oil market as well with prices dropping hard amid hopes for US-Iran de-escalation. WTI crude oil is down over 5% to $62.23, falling back to test its 200-day moving average after last week's rise.