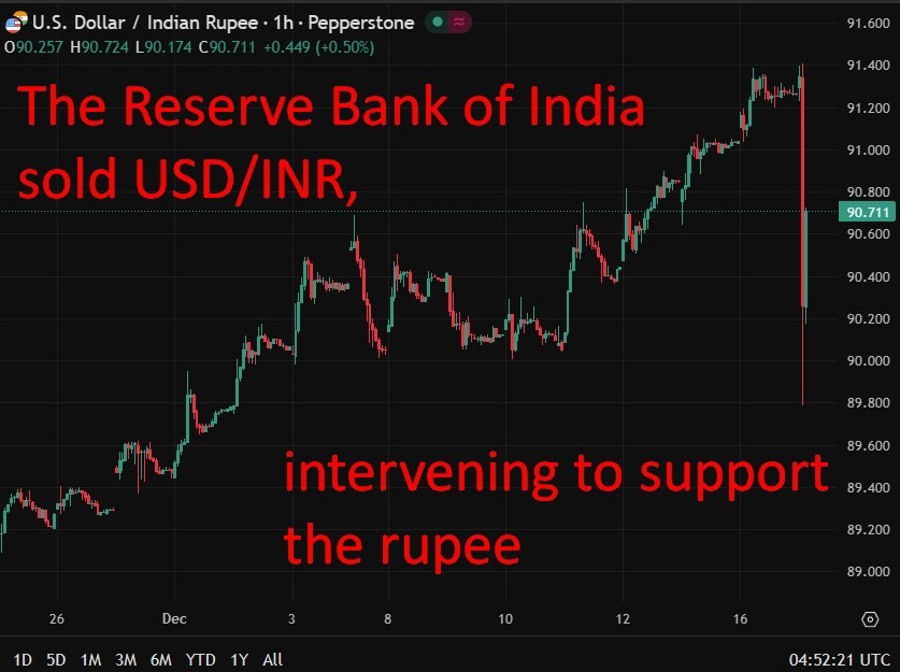

- Reserve Bank of India FX intervention to support the rupee

- Singapore central bank (MAS) survey shows stronger 2025 growth, policy seen on hold

- Singapore exports beat expectations as electronics and pharma lift NODX

- China slowdown raises downside risks for AUD and Australian assets

- Strong exports lift BoJ hike odds as Japan recovery gathers pace - recap

- Weak yen clears path for December BoJ hike, if yen fails afterwards another hike to come

- India’s central bank governor says US trade deal impact about 0.5% on GDP growth rate

- Pot shots - Trump set to fast-track cannabis reclassification under executive order

- Silver hits record ~US$65 per ounce on tight supply and strong demand

- PBOC sets USD/ CNY central rate at 7.0573 (vs. estimate at 7.0386)

- Trump orders blockade of sanctioned Venezuelan oil tankers, crude oil price jumps

- California judge backs up to 30-day Tesla cars sales suspension over Autopilot marketing

- Trump orders total blockade of sanctioned oil tankers entering or leaving Venezuela

- Japan: Nov exports +6.1%y/y (expected +4.8%) Oct Machine orders +12.5%y/y (expected +3.6%)

- Goldman Sachs says Fed more willing to cut rates again next year, citing job market risk

- Port of Los Angeles sees sharp import drop as trade uncertainty bites

- Alphabet (Google)-backed Waymo explores $15bn-plus funding round at near $100bn valuation

- Reports that the White House is divided over Hassett as possible Fed chair

- Oil: Private survey of inventory shows a headline crude oil draw much larger than expected

- Westpac pushes back on RBA hike calls, sees rates on hold through 2026

- New Zealand Q3 current account deficit widens sharply, annual gap improves

- Tesla hits record high as robotaxi optimism outweighs EV sales headwinds

- U.S. Stocks close mostly lower amid cautious sentiment

Oil prices rebounded during the session after sliding to their lowest levels since February 2021 in U.S. trade on Tuesday. The catalyst was President Donald Trump’s announcement that he had ordered a “complete blockade” of sanctioned oil tankers entering and leaving Venezuela, escalating pressure on Caracas amid an expanded U.S. military presence in the region and renewed threats of land strikes. The move injected fresh geopolitical risk into energy markets and helped lift crude from deeply oversold levels.

The yen was another key mover. Higher oil prices added to the currency’s headwinds, while renewed concerns around financial stability were reinforced by another sell-off in Japanese Government Bonds. The benchmark 10-year JGB yield climbed to its highest level since June 2007. USD/JPY rose from early-session lows below 154.55 to trade back above 155.10 at the time of writing.

The renewed yen weakness comes at an awkward moment for the Bank of Japan. The central bank is widely expected to raise its short-term policy rate from 0.5% to 0.75% at its meeting on Thursday and Friday, with the decision due Friday. If yen depreciation persists through and beyond the meeting, pressure will likely build for further tightening early next year.

Data out of Japan were supportive, with trade figures and machinery orders beating expectations, reinforcing the view that underlying growth momentum is improving.

More broadly, the U.S. dollar recovered modestly after Tuesday’s pullback, with FX markets otherwise relatively contained.

In U.S. equity news, Waymo, Alphabet’s autonomous driving unit, is reported to be in early discussions to raise more than $15bn at a valuation approaching $100bn, highlighting renewed investor confidence in the long-term potential of robotaxi technology. Separately, a U.S. judge ruled Tesla’s Autopilot marketing was deceptive, recommending a temporary 30-day suspension of its sales licence, though regulators have granted the company time to amend its language.

Gold also moved higher, but once again lagged silver, which pushed to a fresh record high just shy of US$66.

In Asia FX, the South Korean won slid to its weakest level in over eight months amid sustained foreign equity outflows and steady dollar demand. The Indian rupee edged lower as well, before the Reserve Bank of India stepped in to support the currency via selling USD/INR intervention.

Asia-Pac stocks:

- Japan (Nikkei 225) -0.16%

- Hong Kong (Hang Seng) +0.22%

- Shanghai Composite +0.17%

- Australia (S&P/ASX 200) -0.28%