- China likely to lower 2026 growth target as global slowdown weighs

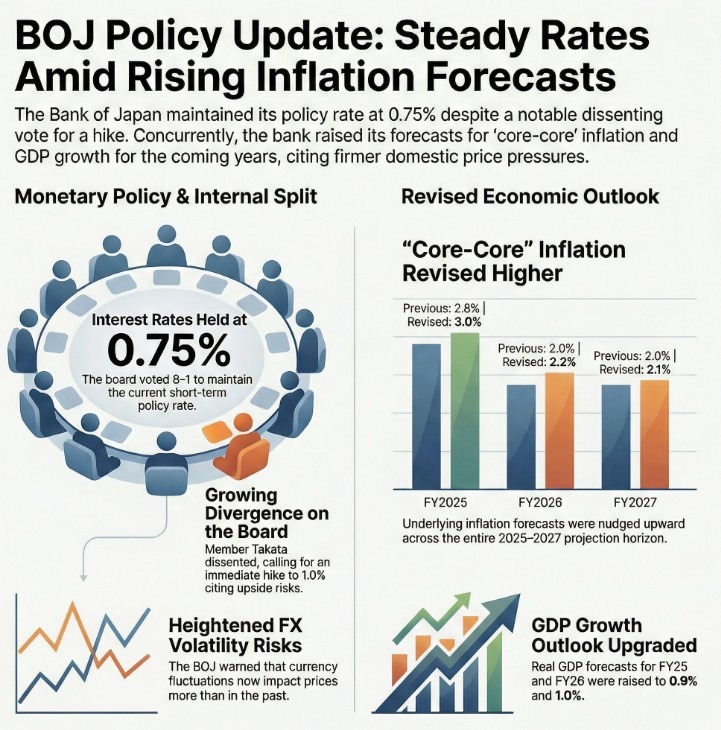

- BOJ holds rates at 0.75%, Lifts core inflation outlook. Dissent highlights inflation risk

- Bank of Japan leaves short term rate on hold, as expected

- RBNZ Governor Breman vows to return inflation to 2% after CPI edges above target band

- Japan says bond market stress has eased as volatility persists

- Buffett’s real investment strategy was quality and intangible value, not bargain hunting

- PBOC sets USD/ CNY reference rate today at 6.9929 (vs. estimate 6.9481)

- TikTok strikes deal to spin off US business under Oracle-led venture, secures US presence

- Japan core inflation slows but stays above BOJ target

- Japan PMI hits 17-month high as manufacturing returns to growth

- UK consumer confidence ticks higher as personal finance outlook improves

- EU closes in on Ukraine recovery deal, boosts Arctic security focus: EU Pres von der Leyen

- UBS warns funding flows, not selling, are key risk for US fiscal outlook

- Japan December 2025 Headline CPI 2.1% y/y (prior 2.9%)

- New Zealand inflation rises above target as domestic pressures persist

- Australia PMI January jump. Business activity accelerates. Composite highest since Apr 22

- ICYMI - PBOC Governor signals further rate and RRR cuts as China keeps loose policy stance

- Trump speaking, ignore him. The real news is there will be no $2K checks sent out.

- New Zealand Q4 CPI 0.6% q/q (expected 0.5%, prior 1.0%) & 3.1% y/y (expected 3%, prior 3%)

- Intel beats Q4 earnings expectations but flags softer margins and revenue in Q1

- investingLive Americas market news wrap: US PCE inflation runs a tad hot

At a glance:

New Zealand Q4 CPI surprised to the upside, lifting annual inflation above the RBNZ target band and briefly supporting the NZD

Australian PMI data signalled a strong start to 2026 as services activity surged and price pressures eased

Japan CPI slowed on headline measures, but underlying inflation remained firm ahead of the BOJ decision

China’s PBOC reinforced its easing bias with a stronger yuan fix and record liquidity injections

BOJ held rates but revealed growing internal debate, while Japanese political risk rose with a snap election call

New Zealand inflation was the first key regional driver, with Q4 CPI rising 0.6% q/q and lifting annual inflation to 3.1%, pushing it above the Reserve Bank of New Zealand’s 1–3% target band. The increase was driven by domestic cost pressures, with non-tradeable inflation at 3.5%, reinforcing expectations the RBNZ will remain on hold. The New Zealand dollar initially strengthened on the release.

Later in the session, the RBNZ’s sectoral factor model showed inflation at 2.8% y/y in Q4, up from 2.7% in Q3 and marking the first increase since Q1 2023. While still above the 2% midpoint target, the release failed to extend NZD gains. NZD/USD gave back early strength, while AUD/USD followed a similar pattern and finished little changed.

In Australia, January flash PMI data pointed to a strong start to 2026. The composite index jumped to 55.5, driven primarily by a sharp improvement in services activity and a solid lift in new orders. Importantly for policy expectations, price pressures moderated, with both input and output price indicators easing and selling price inflation remaining subdued.

Japan’s December CPI showed headline inflation cooling for the first time in four months. The BOJ’s preferred measure, CPI excluding fresh food, rose 2.4% y/y, down from 3.0% in November and in line with expectations. The slowdown reflected a double subsidy effect: newly introduced fuel subsidies lowered costs in December, while the removal of energy subsidies a year earlier inflated the comparison base. However, underlying pressures remain firm, with core-core CPI rising 2.9%, highlighting persistent domestic inflation as the BOJ headed into its policy decision.

USD/JPY edged modestly higher through the session ahead of the BOJ announcement, with limited conviction. The central bank ultimately kept its policy rate at 0.75%, but the decision was split, with one board member voting for an immediate hike to 1.0%. The BOJ revised up several inflation projections and improved its growth outlook, underscoring a growing internal debate over the pace of normalisation. USD/JPY saw only limited post-decision volatility, with focus now shifting to Governor Ueda’s press conference (0630 GMT/0130 US Eastern time).

In China, the PBOC fixed the yuan at 6.9929 per dollar, the strongest CNY midpoint, and the first time for USD/CNY beneath the psychologically important 7-per-dollar level, since May 2023. Also note that the Bank injected a record 1 trillion yuan of medium- to long-term liquidity in January via reverse repos and the MLF, reinforcing its easing bias ahead of Lunar New Year cash demand to come in February.

Political risk also came into focus in Japan, with Prime Minister Sanae Takaichi dissolving the lower house and calling a snap election for February 8, triggering the shortest campaign period on record. Separately, Japan’s finance minister said authorities remain on high alert as market volatility persists, though bond market stress appears to have eased.

Asia-Pac stocks:

- Japan (Nikkei 225) +0.29%

- Hong Kong (Hang Seng) +0.33%

- Shanghai Composite +0.27%

- Australia (S&P/ASX 200) +0.06%