- Fed's Waller: Based on current data, a 25 bps cut is justified at upcoming meeting

- More from Waller: Labor supply issues masking weakness in labor demand

- White House: Trump feels tehre was progress in meeting with Putin

- Kremlin Aide:Call was substantive and open. Leaders discuss possible Tomahawk deliveries

- US EIA weekly crude oil inventories +3524K vs +288K expected

- BOJ's Shimizu says must tread carefully on normalizing policy

- BOJ's Ueda: My view on global economy hasn't changed

- China foreign minister: China and US should conduct effective communications

- NAHB US October housing market index 37 vs 33 expected

- October Philly Fed -12.8 vs +8.5 expected

- USTR Greer: China is taking actions as if it wants to decouple

- Canada September housing starts 279.2K vs 255.0K expected

Markets:

- Gold up $110 to $4319

- WTI crude oil down 81-cents to $57.46

- S&P 500 down 0.6%

- Bitcoin down 2.3%

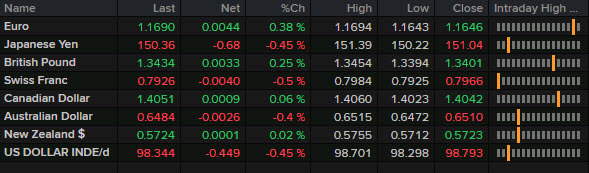

- CHF leads, AUD lags

- US 10-year yields down 7.1 bps to 3.97%

Gold continues to be the most-remarkable story of the moment as the parabolic move accelerated today with a +$110 day and new record above $4300. The move was aided by falling Treasury yields but was otherwise a symptom of intense momentum. That buyers continued to buy every small dip despite a poor backdrop in equities was telling.

US equities started off strongly but the selling hit quickly. One drag was banks, after Zions Bancorp took a $50 million writedown on what appear to be fraudulent loans. That magnified worries about lending fraud following the First Brands' bankruptcy. US-China trade worries are also weighing as a few more statements crossed today but otherwise there weren't any real developments.

The comments from Waller didn't move the needle much on rate expectations as he talked about 50 bps but also moving carefully. He continued the Fed theme of highlighting a weakening jobs market, adding to the sense that the FOMC saw the September jobs report before the government shutdown.

The euro made headway against the US dollar as lower yields and lower oil prices highlighted the opportunity for the Fed to cut rates more deeply. By the same token, the yen was strong as a BOJ official indicated no urgency to cut rates.