- US September ADP employment -32K vs +50K expected

- US September ISM manufacturing index 49.1 vs 49.0 expected

- US September final S&P Global manufacturing PMI 52.0 vs 52.0 prelim

- Canada September S&P Global manufacturing PMI 47.7 vs 48.3 prior

- BOC Minutes: Members agreed inflation indicators pointed to 2.5%

- Atlanta Fed GDPNow Q3 estimate 3.8% vs 3.9% prior but we will soon be flying blind

- Trump says tariff money will go to soybean farmers

- Supreme Court refuses to let Trump immediately fire Fed's Lisa Cook

- Fitch says US government shutdown does not have near-term implications for rating

Markets:

- WTI crude down 36-cents to $62.01

- US 10-year yields down 4 bps to 4.11%

- Gold up $7 to $3865

- S&P 500 up 27 points, or 0.4%, to fresh record

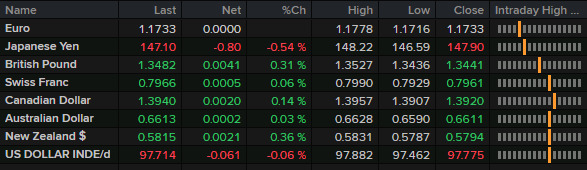

- JPY leads, CAD lags

The ADP employment report might be the only one we get this month due to the US government shut down but it may have given markets something to think about. Jobs fell into negative territory and the prior report was revised below zero as well. The initial reaction was to sell the US dollar and USD/JPY dropped to 146.59. That would prove to be a session low, though it would be tested again later.

The dollar stabilized after the data in part because ISM manufacturing data improved slightly. Flows into US equities also helped as they recovered from a 0.4% loss to a 0.4% gain just ahead of the close. Health care stocks were strong as Trump indicated he will negotiate on pharma imports rather than impose tariffs. LLY, MRK and PFE all gained more than 7%.

Nike was also strong as it highlighted better-than-feared quarterly sales and Intel rallied on a foundry proposal with AMD. Financials were the laggards.

Gold and silver finished higher but gave back some of the earlier gains as profit taking hit gold ahead of $3900. Oil continued to sag ahead of this weekend's OPEC meeting.

Bond markets priced in a more-dovish Fed rate path after ADP with 46.6 bps in easing now in the market through year end and 106 bps in the year ahead.