- US initial jobless claims 263K versus 235K estimate

- US August CPI 2.9% y/y vs 2.9% expected

- ECB leaves key interest rates unchanged in September monetary policy meeting, as expected

- ECB nudges up 2025 and 2026 inflation forecasts, trims 2027. Euro slips

- Lagarde press conference: Headwinds on growth should fade next year

- ECB sources: The rate-cut debate is not over but real discussion not until December

- ECB policymakers are convinced that no further rate cuts are needed to deliver 2% inflaton

- US August federal budget deficit 345.0 billion vs 285.5 billion expected

- Tesla shares break the summer high and rise to the best level since February

- The US treasury auctions off $22 billion of 30 year bonds at a high yield of 4.651%

- Freddie Mac: US 30 year mortgage rate falls to 6.35% from 6.5% last week

Markets:

- Gold down $3 to $3636

- WTI crude oil down $1.40 to $62.27

- US 10-year yields down 1 bps to 4.02%

- S&P 500 up 28 points, or 0.9%, to record 6590

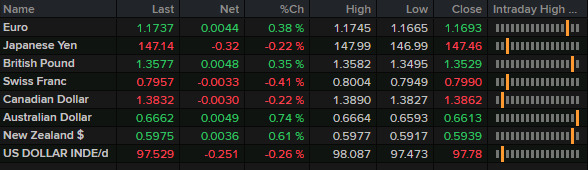

- AUD leads, USD lags

CPI got top billing today but initial jobless claims stole the show. The inflation numbers were a tad hot but the market took a dovish view because claims rose to the highest since 2021. That has the market nearly fully prices for three quarter-point rate cuts this year and led to a big drop in the US dollar and a fresh record in stock markets.

A caveat to the jobless claims report was that Texas had an unusual surge in claims but there was no looking back as the moves in markets were strong and steady.

The euro gained against the US dollar but it was essentially a mid-performer following the ECB. There were some gains as Lagarde shifted the balance of growth risks to neutral from negative but there were certainly no game changers in the press conference.

US 10-year yields briefly touched below 4% for the first time since Liberation Day and that led to a broadening of the equity market rally as today's gains were led by financials and non-tech stocks for the most part.

The Australian dollar helped to confirm the shift as it broke through the July high to the best levels since November 2024.