- August US ADP employment +54K vs +65K expected

- ISM August services PMI 52.0 vs 51.0 expected

- US September S&P Global final services PMI 54.5 vs 55.4 prelim

- US initial jobless claims 237K vs 230K expected

- Fed's Williams says he expects rates to come down gradually over time

- Williams: Expects tariff impact to play out into the middle of next year

- More from Williams: Sees reduced upside risk to inflation from tariffs

- US EIA weekly oil inventories +2415K vs -2031K expected

- Miran says tightening US borders is 'deflationary'

- Miran: No one in the Trump admin has asked me to lower rates

- Canada July trade balance -4.94B vs -4.75B expected

- US Q2 unit labor costs +1.0% vs +1.2% expected

- US July trade balance -78.3B vs -75.7B expected

Markets:

- Gold down $8 to $3550

- WTI down 71-cents to $63.26

- S&P 500 up 53 points to 6501

- US 10-year yields down 4.6 bps to 4.16%

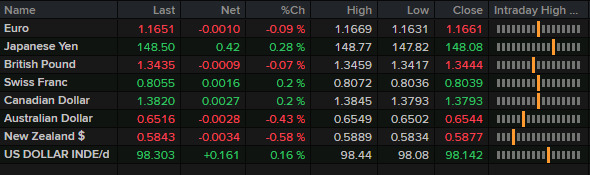

- USD leads, NZD lags

The stock market liked what it saw in the economic data on Thursday as a wave of releases painted a picture of an economy that's subdued but not crumbling. Yesterday's Beige Book and JOLTS data triggered some fears of a harder landing but today's numbers -- particularly the ISM services data, highlighted middling growth. That kind of trajectory is a good one for continued rate cuts even if it doesn't mean strong demand. With that, the S&P 500 finished at the highest daily close ever at 6202 and just shy of the intraday record. It was a nice rally given that the index was in negative territory shortly after the open.

The same dynamic helped to lift the US dollar as some fears were allayed. The gains were mostly modest but it was enough to wipe out yesterday's decline in USD/JPY.

Naturally, there is some angst about Friday's non-farm payrolls report but the market wasn't showing a great deal of anxiety.