- US September Philly Fed business index +23.2 vs +2.5 expected

- US initial jobless claims 231K vs 240K expected

- BOE leaves bank rate unchanged at 4.00% in September monetary policy decision

- BOE's Bailey: I think there will be further reductions in bank rate

- US sells 10-year TIPS at 1.734% -- big tail

- Trump: If crude price drops, Putin will have no choice but to end the war

- Trump: UK wants to make adjustments on trade deal

- Trump: Putin has let me down

- Shares of Intel soar 25% at the open after Nvidia pledges $5 billion stock investment

Markets:

- Gold down $13 to $3645

- WTI crude oil down 37-cents to $63.68

- US 10-year yields up 3.4 bps to 4.11%

- Bitcoin up 1.6%

- S&P 500 up 0.5%

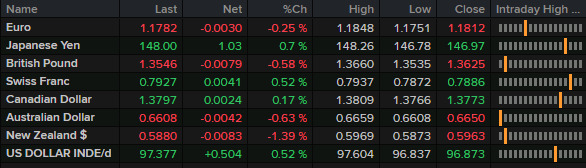

- USD leads, NZD lags

There were differing views in markets as they digested the Fed decision. Bonds sold off on Powell's 'risk management' rate cut and the rates curve got a bit less dovish. That also lent a big bid to the US dollar, particularly against the yen as that pair returned to 1.48 after a brief trip to 1.4550 yesterday. The pound also sagged in part due to dovish comments from Bailey following the rate decision.

The stock market didn't share the same hawkish take as the main indexes opened strongly and hit fresh records. The Russell 2000 was particularly strong (up +2.5%) and it's usually the most-rate sensitive spot. The strength may reflect the knee-jerk buy-the-dip mode in equities since April and that's an increasingly powerful force.

Shares of Intel had a meme-worthy 25% gain at the open that faded only slightly as the day went on. That came following a $5 blllion investment from Nvidia.

Gold and oil markets retreated slightly with crude sliding after a report saying that Trump had been successful in convincing Europeans to cut LNG imports (but not oil). Notably, Trump has taken more-hawkish talking points on Russia lately.