- US August ISM manufacturing 48.7 vs 49.0 expected

- US July construction spending -0.1% vs -0.1% expected

- US August S&P Global final manufacturing PMI 53.0 vs 53.3 prelim

- August Canada S&P Global manufacturing PMI 48.3 vs 46.1 prior

- Trump: We're going to the Supreme Court tomorrow on tariff decision

- Trump confirms that Space Command will move to Alabama

- Trump: China, India and Brazil kill us with tariffs

- ECB's Muller: It makes sense to hold rates and watch the economy

- Atlanta Fed GDPNow Q3 tracker 3.0% vs 3.5% prior

- Goldman Sachs bumps US economic growth tracker to 1.7% for Q3

- New Zealand GDT price index -4.3%

Markets:

- Gold up $62 to $3538

- US 10-year yields up 5.6 bps to 4.97%

- S&P 500 down 48 points to 6412

- WTI crude oil up $1.63 to $65.64

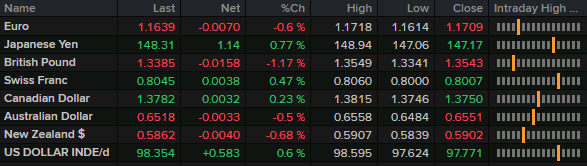

- USD leads, JPY lags

It was an ugly risk-off day to mark the start of the US trading week (following Monday's holiday) but it wasn't as bad as it could be. Futures cracked further early in US trade and were down more than 1.3% at the lows. There was some moderate recover from there that came in spurts. Ultimately the S&P 500 finished 45 points above the lows but still down by 45 points.

The US dollar was strong and choppy. Early in US trade there was some heavy selling and a retracement that saw USD/JPY give back 50% of its gains. The move was short-lived though as dollar buyers returned as the day wore on. That wasn't enough to break the early extremes but it resulted in some sizeable moves across the FX market.

The big talk was in gold, which touched $3500 for the first time in Asia before retracing. It fell back to $3475 early in US trading before exploding higher to $3538 and closing at the highs. That helps to confirm a breakout to the consolidation that kicked off in April.

Oil was also lively as WTI hit $66.00 only to fall back to $64.55, then turn again to $65.64 per barrel.

In terms of equity market movers, the losers vastly outnumbered the winners with financials and transports as laggards. Nvidia was down 1.8% while Tesla fell 1.4%.