- French PM Bayrou loses confidence vote in national assembly

- NY Fed August consumer inflation expectations: One year ahead 3.2% vs 3.1% prior

- US August employment trends 106.41 vs 107.55 prior

- ECB's Villeroy: We are in a good position with inflation in Europe

- Netanyahu: Forces are now organizing and assembling into Gaza City

- China's Xi: Should adhere to openness and win-win cooperation

Markets:

- Gold up $5 to $3636 -- fresh record

- WTI crude oil up $0.50 to $62.38

- US 10-year yields down 3.9 bps to 4.05%

- S&P 500 up 0.2%

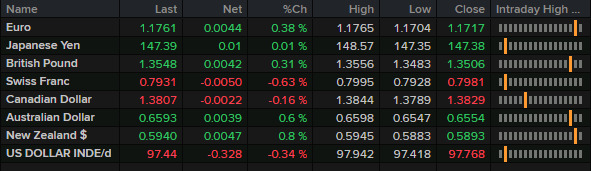

- NZD leads, JPY lags

It was a tough day to pin down what was behind price action. The weekend resignation of Japan's Prime Minister led to some moderate yen weakness at the open but it was steadily faded and ultimately, the entire 120 pip move was erased and USD/JPY finished the day flat.

The problem with avoiding political instability is that there is nowhere to go. France demonstrated that late in the day as the Prime Minister there was defeated and will need to be replaced. The euro briefly wobbled on that but ultimately rose.

The undercurrent of the entire market was US dollar weakness, in part due to declining yields. The market is now pricing in a 10% chance of a 50 bps cut on September 17.

A notable technical development came late in the day as the euro crept above Friday's high to 1.1765 while the pound flirted with Friday's high as well. The dollar selling is largely because the Fed has far more room to cut if the economy weakens. The NY Fed survey headlines ultimately weren't about slightly higher 1 year inflation expectations but that optimism about finding a job fell to the lowest since the survey started in 2013.

Finally, gold notched yet-another record as it has gained for the 5th time in 6 trading days.