- S&P and NASDAQ indices set records once again. Dow industrial average closes unchanged

- French President Macron says is a potential path to a government budget by December 31

- Gold comes off it price as it backs off the high of channel resistance

- We have no idea what's coming as rich boomers age

- Crude oil futures settle at $62.55

- Carney: Had a meeting with Trump on the future of steel and auto sectors

- FOMC Minutes: Most participants judged it likely appropriate to ease further in 2025

- U.S. Treasury auctions off $39 billion of 10 year notes at a high yield of 4.117%

- European stock markets power to strong gains: Looks like a breakout in the DAX

- BOE's Pill: Mon policymakers should make a clear and credible commitment to targets

- EIA weekly crude oil inventories +3715K vs +1830K expected

- The great manias can be summarized with a very simple thesis

- Another production shortfall highlights the opportunity in copper

- One chart showing why it could still be early days in the gold rally

- Nvidia's Jensen Huang said he's most-excited about four AI applications

- The USD is higher to start the day with the USDJPY leading the way again

- investingLive European markets wrap: Dollar, gold enjoying their time in the sun

- US MBA mortgage applications w.e. 3 October -4.7% vs -12.7% prior

Spot gold ran above the $4000 in trading today reaching a high for the day at $4059.31. Buyers remain in firm control (see post here for clues that the trend may be over).

Spot Silver also extended to the upside, falling just short of the by for me which reached $40.83 bag in April 2011.

The US dollar moved mostly higher versus the major currencies. The exception was tge AUD where the greenback employed by -0.11%. It was also near unchanged versus the Canadian dollar.

The biggest mover was a rise of 0.51% versus the JPY as the buying continued in the USDJPY. The USDCHF also advanced by 0.46%.

Below are the changes of the USDs change vs the major currencies:

- EUR +0.24%

- JPY +0.54%

- GBP +0.17%

- CHF +0.46%

- CAD +0.03%

- AUD -0.10%

- NZD +0.22%

The NZDUSD moved to the lowest level since April 11 after the RBNZ cut rates by 50 basis points. The expectations was about 50-50 for a 25 basis point cut.

The EURUSD moved to its lowest level since August 27: testing the 61.8% retracement of the move up from the August 1 low at 1.1592 . The low for the day came in at 1.15977: just above that level.

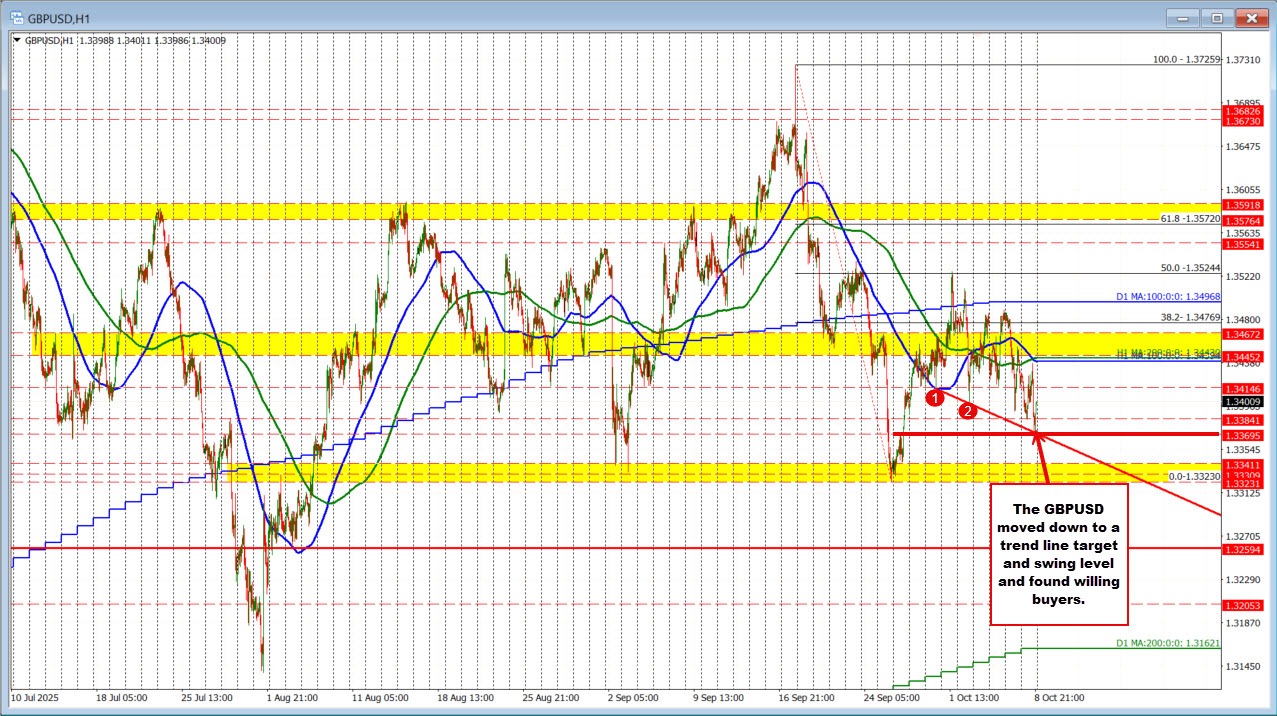

The GBPUSD moved to its lowest level since September 26 testing a downward sloping trendline, and a corrective swing high from the same date at 1.33695. The price Balanced back higher toward the 1.3400 level currently.

There were no economic data releases today. The US government shutdown is in day 8 with no solution in sight. The U.S. Treasury did auction off 10 year notes which was met with average demand. Yields in the US are ending the day higher after being lower at the start of the US session.

- 2-year yield 3.588%, +1.6 basis points

- 5 year yield 3.722%, +1.6 basis points.

- 10 year yield 4.130%, +0.4 basis points

- 30 year yield 4.721%, -0.5 basis points

US stocks continue to ignore the problems in Washington with the shutdown now in day 8. The S&P and NASDAQ indices both closed at record levels once again. The Dow industrial average closed unchanged.

- S&P index rose 39.13 points or 0.58%

- NASDAQ index rose 255.02.01.12 percent

The FOMC minutes showed that most participants agreed it would likely be appropriate to ease policy further over the rest of the year. Almost all members supported the 25bp rate cut in September, though a few saw merit in leaving rates unchanged, and one argued for a 50bp cut.

Some noted that financial conditions may not be particularly restrictive, suggesting a cautious approach was still warranted.

On the economic outlook, most participants judged downside risks to employment had increased, while upside risks to inflation had diminished. Fed staff revised GDP growth projections higher for 2025–2028, though risks remained balanced. Finally, a few participants highlighted that the standing repo facility would help keep the funds rate within its target range and ensure smooth market functioning without disrupting quantitative tightening.

Oil inventory data was mixed with a build in crude oil stocks while gasoline and distillate showed drawdowns. The price of crude oil is trading up $0.68 at $62.41.