Looking at the other US data released today in summary:

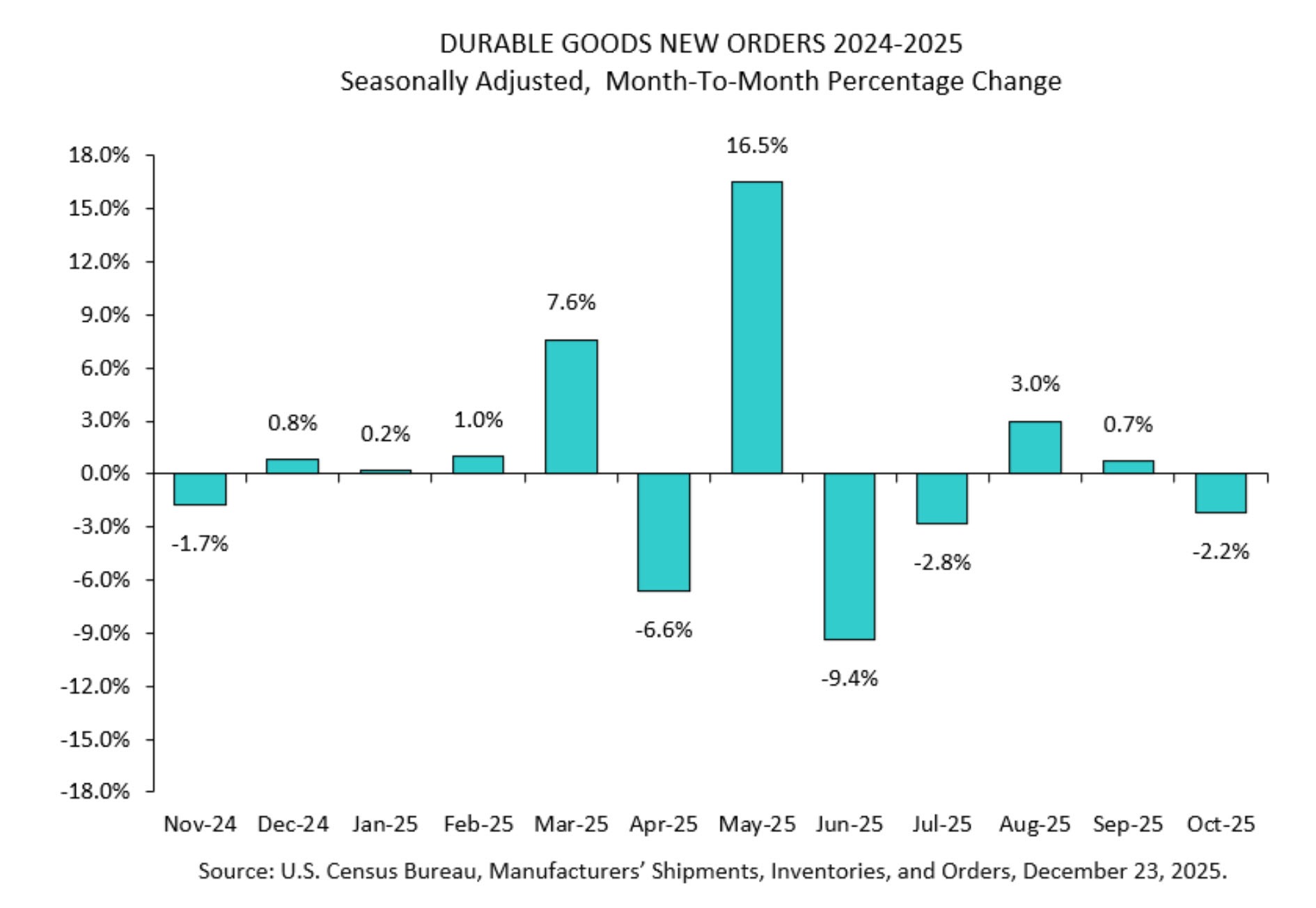

- US Durable goods orders for Oct -2.2% vs -1.5% est. Prior 0.5% revise from 0.7% (lower)

- Ex transportation 0.2% versus 0.3% expected. Prior 0.6% revised 0.7% (lower)

- nondefense capital ex air October 0.5% versus 0.4% expected. Prior revised lower to 0.9% from 1.1%.

- Ex defense -1.5% versus +0.1% prior

- Click HERE for the full report.

Summary of Industrial Production & Capacity Utilization (November 2025)

The Federal Reserve's released Industrial Production and Capacity Utilization data for November and it shows that industrial production staged a modest recovery in November after a tepid October. While the headline index beat expectations, capacity utilization remains steady

Key Data vs. Expectations & Prior

Industrial Production (IP):

November Actual: +0.2%.

Estimate: +0.1% (Beat).

October Revised: -0.1% (Originally reported as flat).

Capacity Utilization:

November Actual: 76.0%.

Estimate: 75.9% (Slight Beat).

October Revised: 75.9%.

Context: This rate remains 3.5 percentage points below the 1972–2024 average of 79.5%.

Major Industry Group Breakdown

Manufacturing: Remained unchanged (0.0%) in November after a -0.4% decline in October.

Mining: Jumped +1.7% in November, a sharp reversal from the -0.8% contraction in October.

Utilities: Decreased -0.4% in November after a volatile +2.6% surge in October.

Market Group Performance

Final Products: Increased +0.4%, led by a recovery in consumer goods (+0.3%) and business equipment (+0.3%).

Construction: Continued to weaken, falling -0.6% in November following a steep -1.1% drop in October.

Materials: Rose +0.2% after remaining flat in the prior month.

Capacity Utilization by Stage

Crude: Rose to 83.7% (from 83.0% in October).

Primary & Semifinished: Fell slightly to 75.4%.

Finished: Edged up to 73.7%.

The "Why" Behind the Numbers

While the +0.2% IP growth beat the 0.1% forecast, the broader trend reveals a stagnant manufacturing sector. The "beat" was largely fueled by a rebound in mining rather than a resurgence in factory output. Persistent headwinds, including tariff uncertainty and slowing discretionary consumer spending, continue to keep capacity utilization (76.0%) near levels seen during previous economic soft patches.

The Trump initiatives to bring back manufacturing to the US should lead to larger numbers down the road. Of course it takes time to build the capacity.