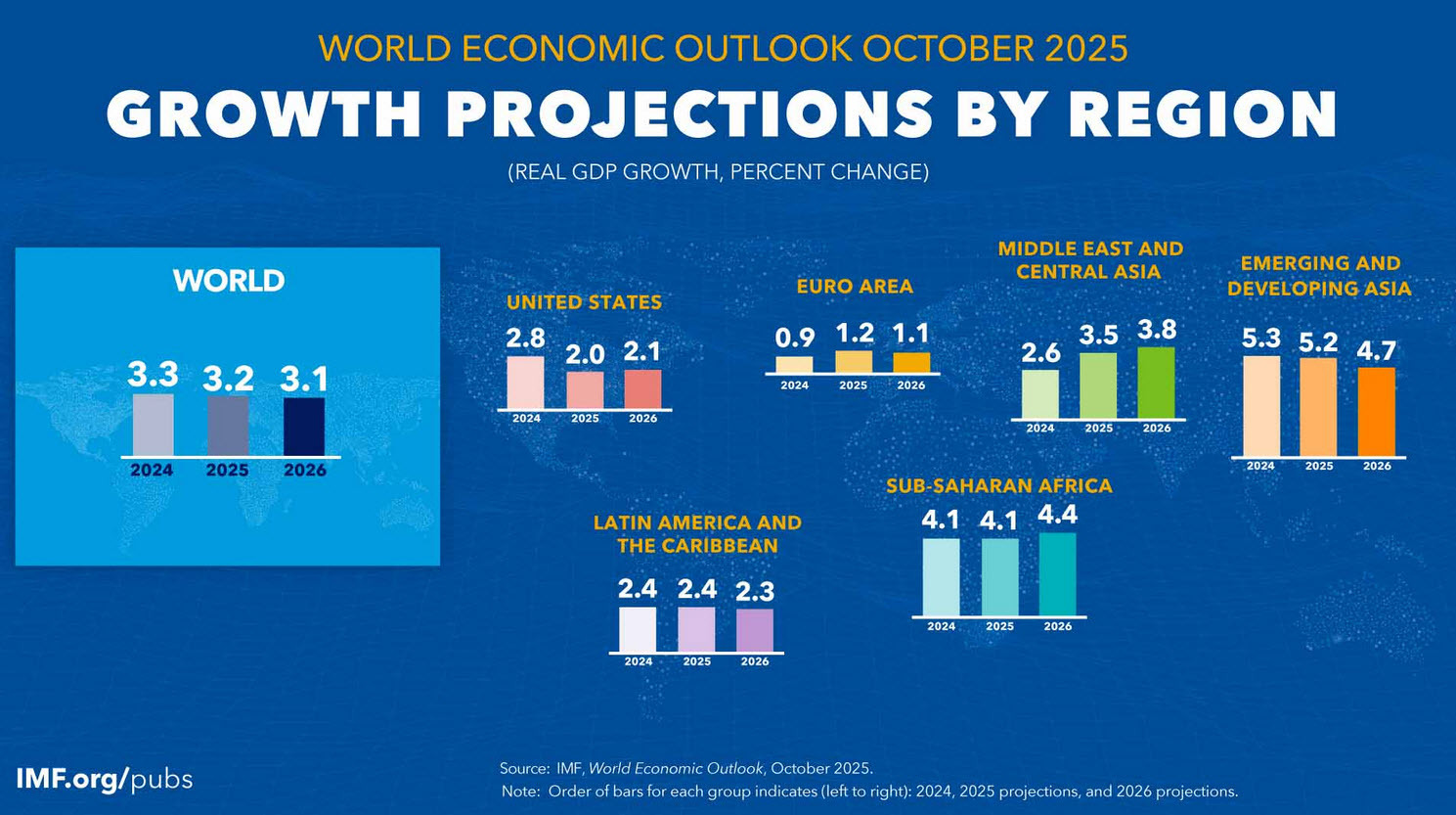

Global 2025: 3.2% vs 3.0%

Global 2026: 3.1% vs 3.1%

U.S. 2025: 2.0% vs 1.9%

U.S. 2026: 2.1% vs 2.0%

IMF says U.S. outlook aided by lower-than-forecast effective tariff rates, tax bill, fiscal boost, easier financial conditions

China 2025: 4.8% vs 4.8%

China 2026: 4.2% vs 4.2%

Eurozone 2025: 1.2% vs 1.0%

Eurozone 2026: 1.1% vs 1.2%

Japan 2025: 1.1% vs 0.7%

Japan 2026: 0.6% vs 0.5%

IMF says BOJ likely to raise interest rates gradually over medium term toward neutral level of 1.5%

Canada 2025 1.2% vs 1.6%

Canada 2026 1.5% vs 1.9%

India 2025/26: 6.6% vs 6.4%

Argentina 2025: 4.5% vs 5.5%

Argentina 2026: 4.0% vs 4.5%

Mexico 2025: 1.0% vs 0.2%

Mexico 2026: 1.5% vs 1.4%

Brazil 2025: 2.4% vs 2.3%

Brazil 2026: 1.9% vs 2.1%

Latin America & Caribbean 2025: 2.4% vs 2.2%

Latin America & Caribbean 2026: 2.3% vs 2.4%

Global headline inflation 2025: 4.2% (from 5.8% in 2024)

Global headline inflation 2026: 3.7% (from 4.2% in 2025)

IMF chief economist Gourinchas said the latest U.S.-China trade tensions represent a downside risk, won't yet alter baseline forecasts. She noted that a material escalation of U.S.-China trade tensions could have big negative impact on global growth

Overall, these numbers highlight the improving view on the trade war as the impacts haven't been as harsh as feared a few months ago.