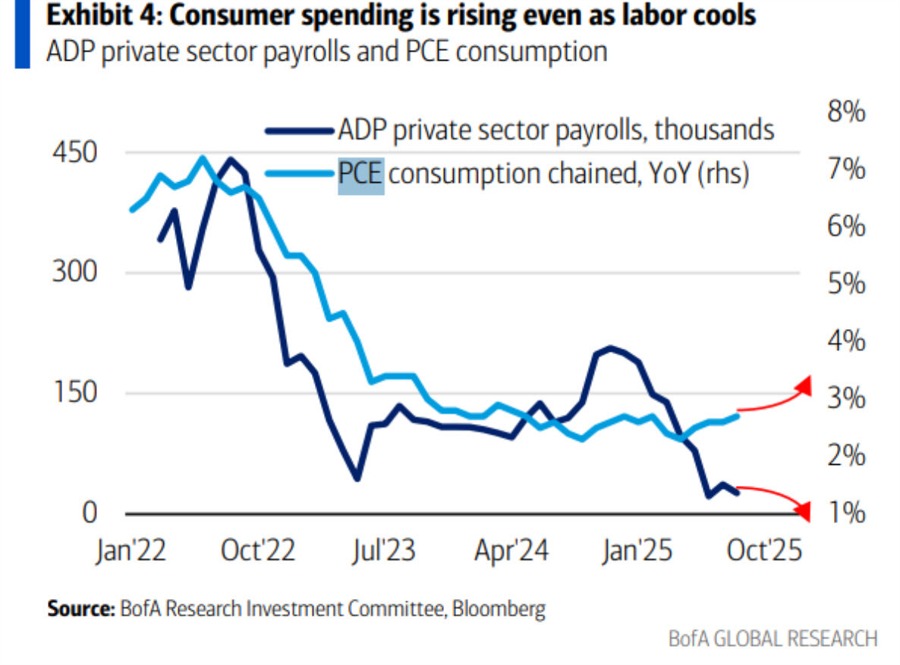

Consider this chart along with some other news today:

- The Fed's Barr saying that "there may be two economies right now, with upper income doing well and lower income struggling

- Delta Airlines citing the same thing and nothing that revenue from premium classes will soon pass coach

- Stock markets keep going up (compounding the wealth effect)

The reason for this -- to me -- is obvious. It's that boomers are retiring flush and continuing to spend.

From the Fed's perspective, it's a big problem as the two mandates can now be in conflict. Previously, as jobs declined, so did inflation because spending dried up. In the future, we could see unemployment rise but spending remain solid (or even increase on aggregate). That would create some real problems for the Fed in trying to decide what to do. What will happen is that they keep rates lower than they should be, continuing to inflate assets and compounding wealth. In many ways, this has been underway for some time but policymakers (and the market more broadly) hasn't recognized it.