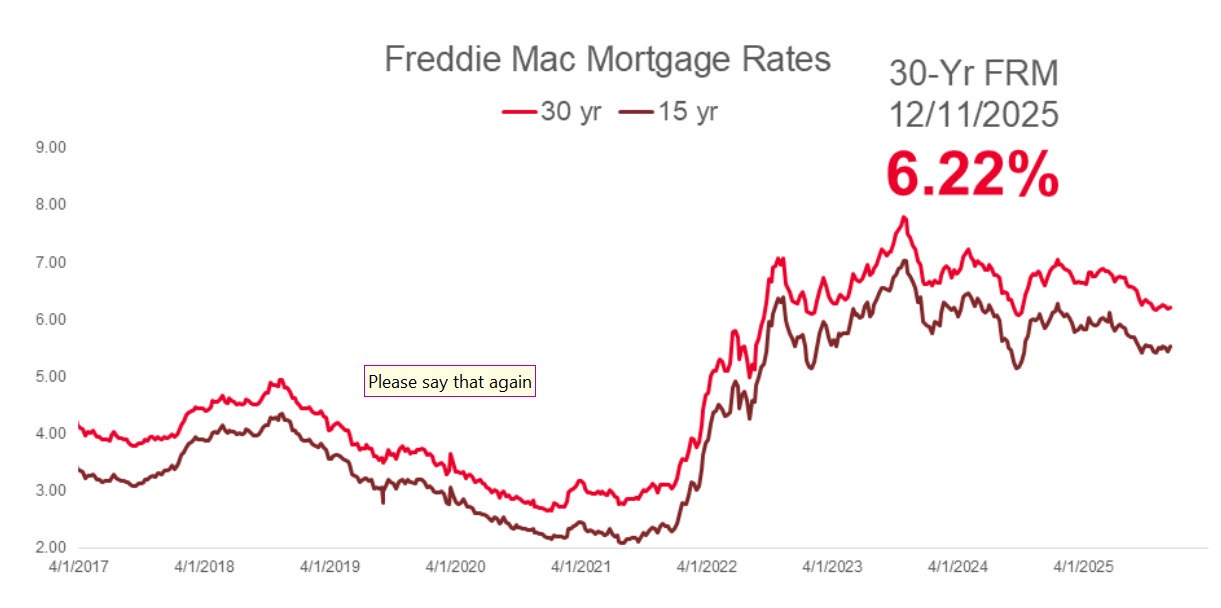

Freddie Mac is reporting that the 30 year fixed-rate mortgage average rate rose to 6.22% from 6.19% in the prior week. The recent cycle lows going back to October 2022 is at 6.09%.

Current Market Snapshot

The housing market continues to navigate a complex environment of fluctuating rates and sticky prices. While the Federal Reserve cut interest rates by 25 basis points yesterday, mortgage rates have moved in the opposite direction this week, highlighting the disconnect that often exists between Fed policy and long-term bond yields.

Mortgage Rates: According to Freddie Mac, the average 30-year fixed mortgage rate rose to 6.22% this week, up from 6.19% the previous week.

- Inventory Levels: Housing supply is slowly recovering but remains approximately 13% below pre-pandemic levels. We are seeing regional disparities, with inventory surging in the South and West (rising above pre-pandemic norms in cities like Denver and Austin) while remaining tight in the Northeast.

- Price Trends: National median list prices are largely flat year-over-year at approximately $424,000. However, about 20% of listings are seeing price cuts, suggesting sellers are having to adjust expectations to meet stretched buyers.

The Affordability Crunch

Affordability remains the primary headwind for prospective buyers. Despite the Fed's easing cycle, the combination of home prices near record highs and mortgage rates above 6% keeps monthly payments elevated.

Delinquencies Outlook: Recent credit reports suggest a modest rise in mortgage delinquencies heading into 2026 as the "affordability squeeze" tests borrower resilience.

Buyer Behavior: A new report from Zillow indicates that many buyers are skipping the "rate shopping" phase in a rush to secure homes, potentially costing them significant savings in a volatile rate environment.

Chair Powell on Housing: The "Lock-In" Effect and Supply

During yesterday’s post-meeting press conference, Federal Reserve Chair Jerome Powell addressed the housing market directly, offering a sobering view on why lower Fed rates haven't immediately fixed the sector's issues.

1. The "Lock-In" Effect is Stifling Supply Powell emphasized that the housing market is effectively "frozen" because millions of Americans are holding onto mortgages with rates between 2% and 3%. Even as the Fed cuts rates, current market rates (near 6%) are too high to entice these owners to sell and move, keeping resale inventory artificially low.

2. Inflation & Housing Services Powell noted that while the Fed has made progress on inflation, housing services inflation remains sticky. He described the current policy stance as "modestly restrictive," which is helping to cool the economy, but he acknowledged that monetary policy alone cannot fix structural housing supply deficits.

3. The Tariff Impact When addressing recent inflation data, Powell attributed much of the current "heat" to tariffs, describing them as a "one-time price increase." However, he warned that if these policy shifts lead to higher costs for construction materials or labor shortages (via immigration changes), it could exacerbate the housing supply shortage further.

Realtor.com 2026 Forecast: A Steady Shift Toward Balance

Overview: "Low Gear" Recovery

Realtor.com recently outlined their projections for US housing in 2026.

They forecast that the US housing market is expected to shift into a steadier, more balanced state in 2026. While not a boom year, conditions will improve modestly for buyers as affordability pressures ease slightly. The market will remain in "low gear," with sales rising slowly from historical lows but still constrained by high prices and rates.

Key Data Projections (2026 vs. 2025)

Mortgage Rates: Expected to average 6.3% for the year (down from an average of 6.6% in 2025). This stability helps buyers budget but keeps the "lock-in" effect in play for existing owners.

Home Prices: Forecast to rise by a modest 2.2% year-over-year. Crucially, inflation is expected to outpace this growth (~3%), meaning real home prices (inflation-adjusted) will actually decline slightly, slowly improving affordability.

Existing-Home Sales: Projected to rise 1.7% to 4.13 million units. This is a small rebound from the 29-year lows seen in 2024-2025.

Inventory: For-sale inventory will grow by 8.9%, marking the third straight year of gains, though levels will still remain ~12% below pre-pandemic norms.

Rents: Rents are forecast to decline by 1.0% nationally as a robust supply of new multi-family units hits the market.

Market Dynamics by Group

For Buyers: "Negotiating power tilts subtly toward buyers." Affordability will improve as incomes grow faster than home prices, pushing the typical mortgage payment share of income below 30% for the first time since 2022.

For Sellers: The market is moving further into "balanced territory." Sellers will face more competition and may need to be flexible on price. Delistings (sellers walking away rather than cutting prices) may continue.

For Renters: A "renter's market" is emerging, particularly in the South and West (e.g., Austin, Las Vegas, Atlanta) where supply is surging.

Economic Backdrop

Inflation & Wages: Inflation is expected to hover around 3%, but wage growth (3.6%) will outpace it, restoring some consumer purchasing power.

Risks: The forecast highlights significant risks, including trade policy/tariffs impacting construction costs and the uncertainty of a Federal Reserve leadership transition when Jerome Powell's term ends in May 2026.

Conclusion

2026 is framed as a year of "slow normalization." It won't be a dramatic return to the frenzied activity of 2020-2021, nor a crash. Instead, it offers a window of stability where inventory creeps up, rates flatten out, and buyers gradually regain some leverage.