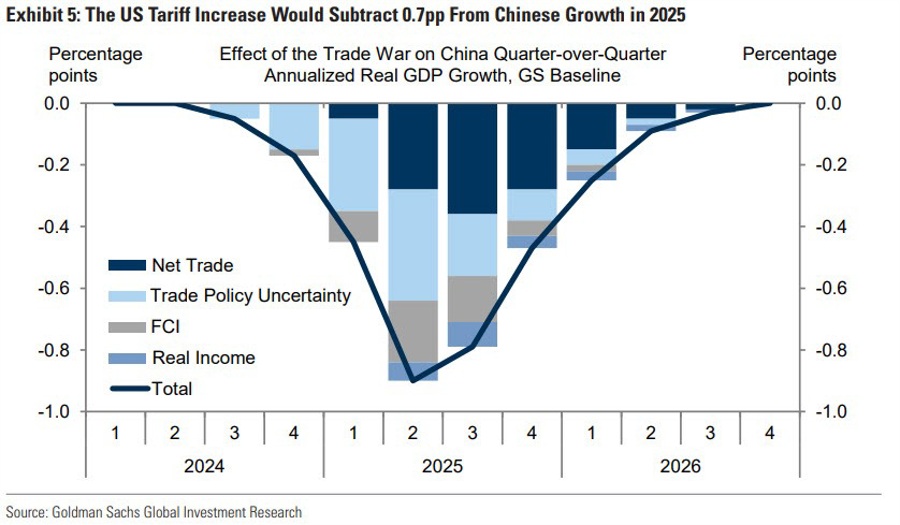

That being said, they are still maintaining their forecast for China's full year 2025 GDP growth at 4.5%. I'm not sure how their estimate works on that but okay. This was their previous baseline forecast in November last year:

That being said, they are still maintaining their forecast for China's full year 2025 GDP growth at 4.5%. I'm not sure how their estimate works on that but okay. This was their previous baseline forecast in November last year:

Most Popular

Futures dip as Fed, earnings & shutdown fears loom. Gold hits record highs. Traders brace for volatility.

Gold surges past $5k, seen as durable hedge. Bitcoin stalls near $87k amid supply overhang & loss-selling; consolidation expected.

Japan's bond yields and stocks tumble as yen rebounds; a $7T risk looms. Traders eye fiscal-monetary clash.

Gold hits $5k, Yen surges on intervention fears. Dollar pressure mounts as traders eye new currency rules.

Plus500 launches weekly options on gold, oil, and indices, targeting active traders amid rising global demand.

Micron's memory cycle boom fuels 10%+ gains; TD Cowen sees sustained growth, eyeing trillion-dollar valuation.

Nikkei tumbles 1.9% as yen surges; Toyota down 3.2%. Gold & silver rally on safe-haven demand.

Must Read