- Prior 49.8

- Services PMI 52.5 vs 49.5 expected

- Prior 49.3

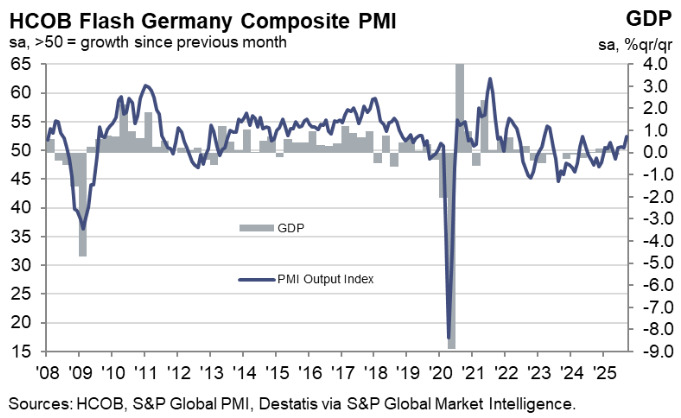

- Composite PMI 52.4 vs 50.6 expected

- Prior 50.5

The manufacturing PMI missed expectations but we had a big jump in the services PMI. The key part here is that "the overall economy is growing at its fastest clip in 16 months" and although the agency is more cautious on this part, there are reasons to expect improvement ahead given Fed rate cuts.

Comment:

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“Trouble seems to be brewing in manufacturing. Sure, companies have been ramping up production for seven straight months, but new orders took a nosedive in September. If demand, both at home and abroad, keeps dropping, it won’t be long before firms hit the brakes on production, too.

“The services sector picked up a bit of steam in September. It is back in growth territory, expanding at the joint-fastest pace we have seen all year. That is a turnaround after five months of mostly declining activity. Still, companies are not exactly bursting with confidence. They have actually dialled back their optimism a notch. Given that orders, including those from abroad, are falling again, it is not hard to see why.

“Costs remain a headache for service providers. In September, input costs, which include wages and energy, rose at the fastest rate since April, pushing services input price inflation further above the long-term average. At least services firms managed to pass some of those higher costs on to their customers. Even so, profits are likely under pressure, which probably explains why jobs in this sector have been cut for two months running.

“The overall economy is growing at its fastest clip in 16 months. But do not get too comfortable. Orders are under pressure, especially in manufacturing but also in services, signalling another slowdown could be on the horizon. Despite the promise of billions in capex and investment incentives, business expectations for the year ahead are pretty muted. That is unlikely to change until these investment projects really get off the ground and become visible, not just here and there, but across the board.”