- Prior 49.3

- Final Composite PMI 52.0 vs 52.4 prelim

- Prior 50.5

Key findings:

- Inflows of new work fall for second month in a row

Comment:

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

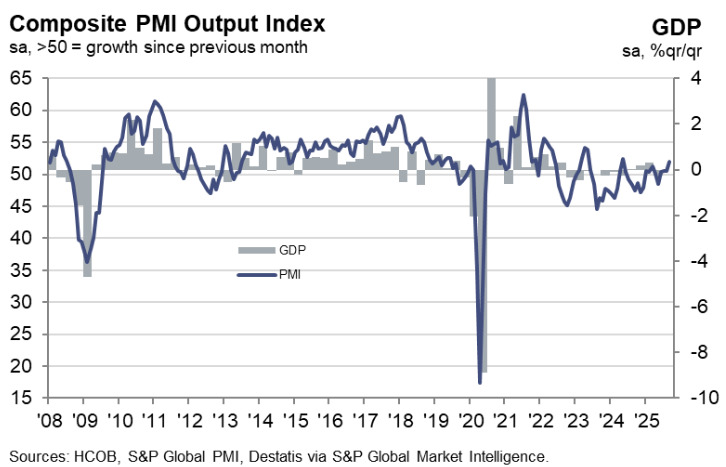

“At first glance, the PMI figures for September are encouraging. The service and manufacturing sectors have together seen a robust increase in output, and the pace of expansion is at its highest in sixteen months. However, there are some downsides. In the manufacturing sector, new orders fell in September, ending a three-month growth streak. And in the service sector, new business has shrunk again, albeit the decrease has softened a bit compared to the previous month. It therefore does not look as if output in the private sector will rise sustainably in the coming months, unless demand revives.

“Cost inflation in the service sector has risen for the second month in a row and is at an above-average level. Given the rather weak performance of this sector over the past twelve months, this is not only unusual but also a problem for the companies affected. This is because the sales difficulties are compounded by rising costs, which can only be passed on to customers to a limited extent. An important factor responsible for these cost increases is likely to be the demographic shortage of skilled workers, which makes staff and human resource planning more expensive.

“Service providers are gradually responding to the slump in orders by cautiously reducing their workforces. Over the past two years, there have been repeated episodes where companies have reduced their employment, but for the most part, the number of jobs has increased. The fact that staff numbers have been cut for two months in a row does not necessarily herald a phase of job losses. However, there is increasing discussion about whether artificial intelligence is already making jobs redundant on a significant scale. It is therefore worth keeping a close eye on this development.”