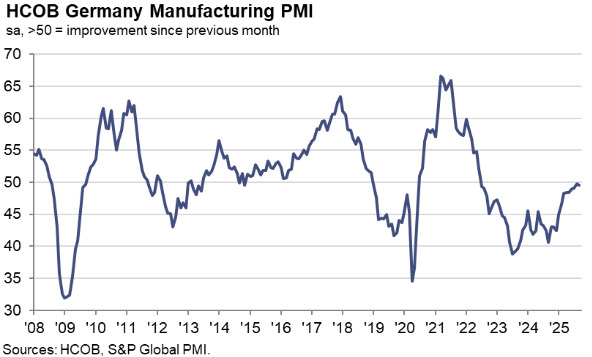

- Prior was 49.8

Key findings:

- Expectations slip to nine-month low as new orders post renewed decline

Comment:

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

"The attempt to break through the expansion mark of 50 has failed. By August, the headline PMI had crept up to just below the critical 50 threshold in several steps, but now there has been another setback, which accurately reflects the fragile situation in the manufacturing sector. Most recently, it was a decline in new orders that has weighed on the manufacturing sector. This development is likely to mean that output, which rose quite solidly in late summer, will grow only marginally in the coming months, if at all.

“Looking at the production figures in isolation, the manufacturing sector appears to be enjoying a healthy upturn, as output has been rising for seven months now. However, other indicators suggest that companies are already preparing for another downturn, as job cuts are continuing at a relatively high pace and inventories of purchased materials are also being reduced, albeit at a slightly slower rate than in previous months. It is quite obvious that the German government's announcements of strong growth in investment and defence procurement in the new budget for 2026 are only being given limited credence. Accordingly, confidence in future production increases has declined to a modest level.

“Industrial companies are currently benefiting from the fact that import prices have fallen quite sharply, while firms cut sales prices only slightly in September, so profit margins should have increased. However, the fact that companies have rarely been able to enforce price increases for over two years now underscores that competition has intensified in general due to the weak economic situation and the ‘China shock’.”