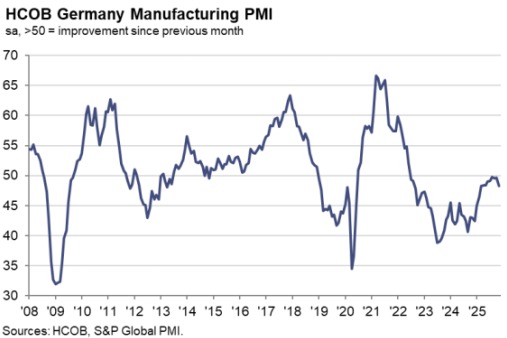

- Prior was 49.6

Key findings:

- Supplier delivery times lengthen for third straight month

Comment:

Commenting on the PMI data, Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“Germany’s manufacturing sector appears to be unable to cross the threshold to expansion. Since July 2022, the headline PMI has been stuck below the 50 mark, and after it looked in recent months as if it might enter growth territory, the index has now slumped again. Although companies have now been increasing production for nine months in a row, other indicators such as order intakes, employment, and inventories clearly show how bad the situation in industry still is.

“Foreign orders have been weak since August, but in November they showed a sharp decline. One explanation could be that the largest buyers of German products to date, US companies, stocked up on imports in the first half of the year in particular and now have correspondingly less demand for goods from Germany. It is certainly also unhelpful that the global manufacturing sector has been more or less stagnating since 2023.

“A look at the sectors shows that production has fallen in the important intermediate goods sector and growth has slowed in the capital goods sector. In the consumer goods sector, there has been only a slight increase in output. It would not be surprising if the series of rising manufacturing output, which has already lasted most of the year, were to come to an end in the coming months. However, this does not necessarily herald a downward trend. This is because expansionary fiscal policy is likely to take effect in the first half of 2026 at the latest, stimulating demand for machinery for the construction industry and for defence equipment, among other things.

“Manufacturing companies continue to reduce their workforces. This has been going on for almost two-and-a-half years. Given the increase in production observed this year, the result is likely to be higher labour productivity, which in itself should also contribute to the international competitiveness of companies. However, the decline in orders from abroad does not reflect this, because competitors from other countries may not be sitting idle either.”