- Prior 44.8

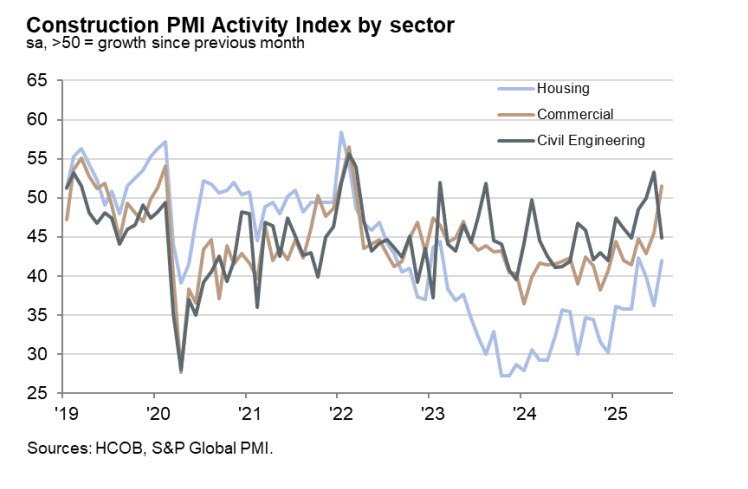

That is the highest reading since February 2023 as the construction downturn in Germany shows further signs of easing in July. Looking at the details, a lot of this owes to a renewed rise in commercial building work (chart below). That being said, firms continued to cut both workforce numbers and purchasing activity, citing a lack of incoming new work. So, there's still headwinds to be had. HCOB notes that:

“Germany’s construction sector continues to show signs of recovery, but the sector is not out of the woods yet. The HCOB Construction PMI indicates the highest reading since February 2023 and has improved by roughly four points since the beginning of the year. On the other hand, the sector remains in deep recession, especially when viewed in comparison with the trends in manufacturing and services. Input prices also continue to rise, and overall, this is no cause for celebration. Construction firms share this view, as their business expectations for the next twelve months remain below the expansion threshold.

“The residential and commercial construction sectors showed some signs of recovery, with commercial construction even expanding for the first time since March 2022 and residential construction contracting at a slower pace. However, civil engineering activity left much to be desired in July following its strong performance in June, with activity in this segment shrinking for the first time in three months.

“The outlook for Germany’s construction sector remains bleak. Not only are construction firms themselves not particularly confident, but new orders, employment conditions, and pricing dynamics also remain subdued. According to anecdotal evidence, new orders continued to decline due to high prices and customer hesitation, which particularly affects residential construction. Employment continued to fall in July, marking a continuous decline over the past 40 months. Input prices rose for the fifth month running, though at a rate that was below the long-term average.”