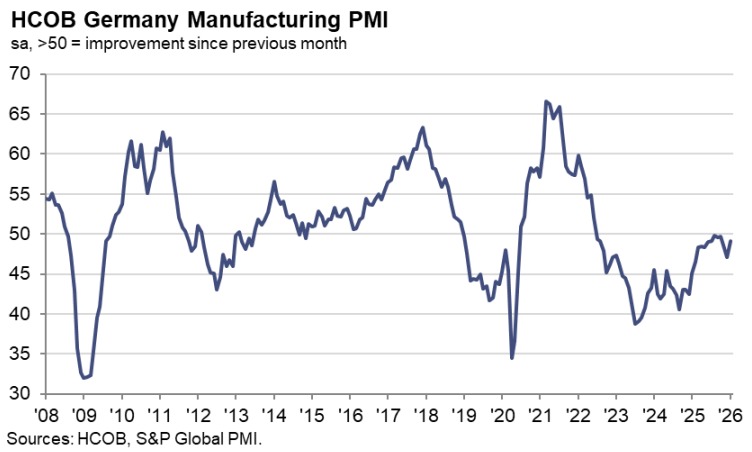

- Prior was 47.0

Key findings:

- Input cost inflation ticks up to 37-month high

Comment:

Commenting on the PMI data, Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“This smells a bit like a recovery could be underway. Output has rebounded rather swiftly from the drop in December, optimism about future output has risen from an already high level, and new orders have ticked up a bit. Hopes for a broader recovery are supported by general anecdotal evidence. Manufacturers seem to see opportunities to pivot toward defencerelated production, where demand is rising amid geopolitical tensions and increased public spending on military goods. The situation remains fragile, though. Companies are still drawing down their inventories at speed, and the backlog of work is shrinking even faster than at the end of last year.

“Input prices are climbing again. Much of this seems tied to the sharp jump in natural gas and oil prices, both driven up by cold weather across Europe and the US. Prices for metals like copper, nickel, and aluminium have also run higher in January compared to December. Companies, however, have struggled to pass these cost pressures on to customers. At best, they’ve managed to slow the ongoing three month decline in output prices, nothing more.

“Firms are continuing to shed jobs at a brisk pace. This likely reflects a combination of productivity enhancing measures and a response to the weak demand environment of the past several years. Those companies that have streamlined their production processes may find themselves well positioned if demand does pick up over the course of this year, as hinted by the improvement in the future output index.”