- Prior 59.6

- Current conditions -65.9 vs - 65.9 expected

- Prior -72.7

Expectations eased slightly from the prior reading but the current conditions improved further. There's been some minor downside in the euro after the release but the data isn't going to change anything for the ECB as it focuses more on inflation. The reaction will likely be faded quickly.

ZEW President Professor Achim Wambach, PhD on the current survey results said: “The ZEW Indicator remains stable. The German economy has entered a phase of recovery, albeit a fragile one. There are still considerable structural challenges, especially for industry and private investment. The impending reforms of the system of social insurances should be used to significantly enhance Germany’s attractiveness as a business location”.

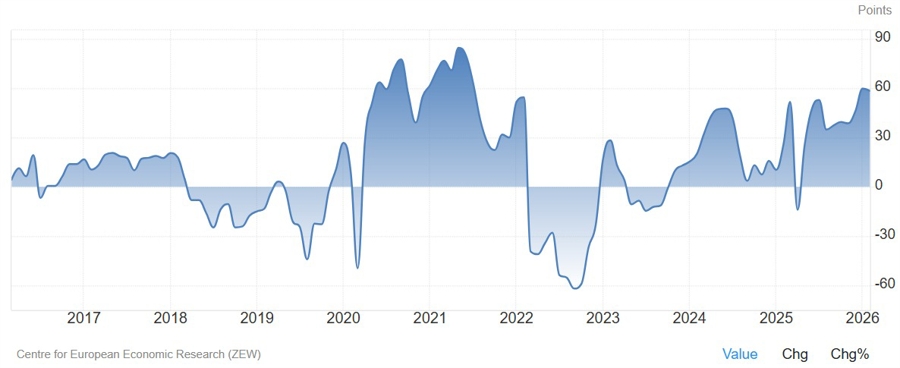

WHAT IS THE ZEW INDEX

The ZEW Indicator of Economic Sentiment is an influential monthly survey that gauges the economic expectations of financial experts in Germany. It is considered a "leading indicator," meaning it is used to gauge the future health of the German economy, the largest in the Eurozone, about six months in advance.

Unlike the Ifo Business Climate Index (which surveys company managers), the ZEW surveys up to 350 institutional investors and financial analysts (from banks, insurance companies, and financial departments). Experts are asked whether they expect the economic situation to improve, stay the same, or worsen over the next six months.

The index is a "diffusion index." It is calculated by subtracting the percentage of pessimistic responses from the percentage of optimistic responses. If the index is above zero, it indicates that the majority of experts are optimistic about future growth. If it's below zero, it signals prevailing pessimism.