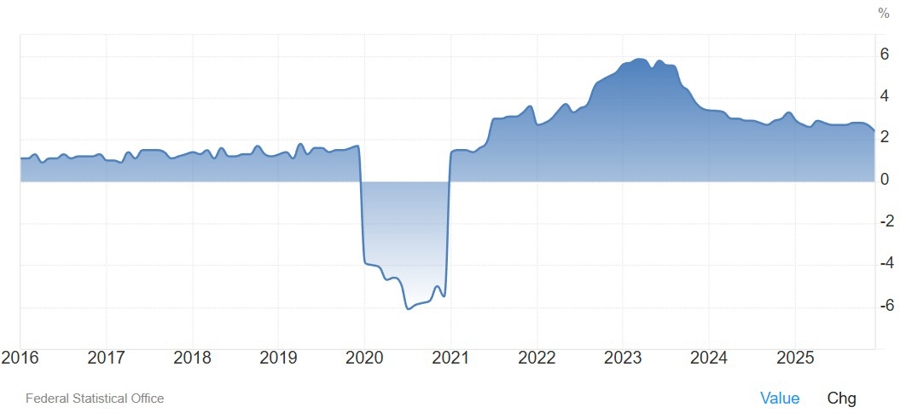

- Prior +2.3%

- HICP +2.0% vs +2.2% y/y expected

- Prior +2.6%

- Core CPI Y/Y 2.4% vs 2.7% prior

- Full report here

Big downside surprise in German inflation figures. We had the German states readings earlier in the session which pointed to softer national CPI. The Core CPI Y/Y fell to 2.4% in December vs 2.7% in November.

The market reaction has been limited given that we already expected softer figures after the German states data. In terms of monetary policy, the data doesn't change anything for the ECB. The central bank is comfortably in neutral stance and has already stated many times that it won't react to small or short-term deviations from its 2% target.

The market doesn't expect any policy move from the ECB this year with just 2 bps of tightening priced in by year-end.

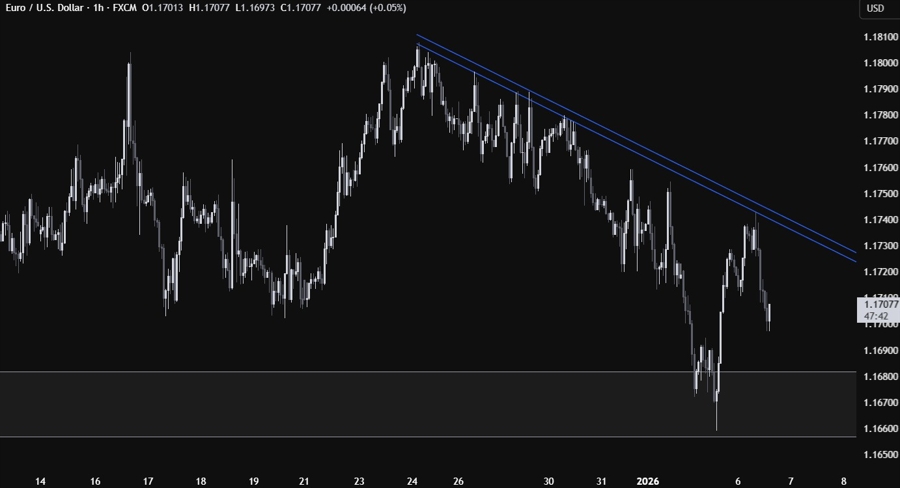

On the 1 hour chart above, we can see that EURUSD bounced following the German CPI data in what could be called a classic "buy the rumor, sell the fact" reaction. The price action has been confined between the support zone around the 1.1660 level and the downward trendline.

The sellers will likely continue to lean on the trendline with a defined risk above it to keep pushing into new lows, while the buyers will need a break above the trendline to open the door for a rally into the 1.18 handle.