- Prior 49.6

- Composite PMI 47.4 vs 46.7 prelim

- Prior 47.8

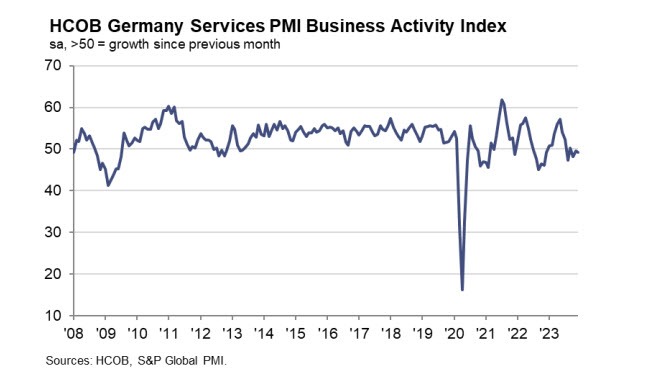

The revision is a positive one to the initial estimate but it still points to a marginal decline in services activity in Germany on the month. According to the survey, the drag stems mostly from tighter financial conditions and broader weakness in the overall economy. HCOB notes that:

“The downward trajectory of service sector output persists for the third consecutive month, with no clear indications of an imminent turnaround. Compounding the situation, the manufacturing PMI remained well below the 50 threshold throughout the entire fourth quarter. This strongly suggests a high likelihood that Germany will undergo two consecutive quarters of declining GDP. If this unfolds, it would signify that the Eurozone's largest economy is in a recession, aligning with our GDP Nowcast, which factors in the PMI indicators.

"If Germany is indeed facing a recession, this one is likely to be categorized as relatively mild by service providers. Historical comparisons reveal more severe downturns in output seen not only during the Covid-19 crisis and the Great Recession of 2008/2009, but also in 2001 when the internet bubble burst.

"Looking at 2023 as a whole, the service sector has experienced a modest expansion of an estimated 0.6%, signaling a considerable slowdown from the robust 3.0% average output increase observed in 2022. Importantly, the service sector is expected to close the year with a negative growth rate, as suggested by PMI indicators. This sets the stage for the sector to kick off the new year with negative momentum.

"In the service sector, inflation remains stubbornly high, defying the economic downturn. Input prices are on a surprisingly rapid ascent. Notably, companies have ramped up their pricing even more swiftly than in the previous month, transferring the rising input costs to their customers, at least partially. This phenomenon may be indicative of persistent labour market shortages, which drives wages. In addition, it suggests little concern among services companies about competitive pressures.”