- Prior 50.6

- Final Composite PMI 50.5 vs 50.9 prelim

- Prior 50.6

Comment:

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

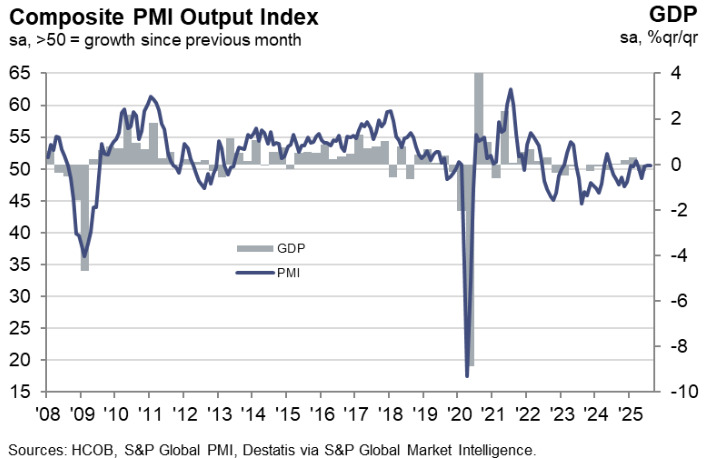

“Economic momentum remains sluggish. Over the summer months, overall growth was just marginally positive. Clearly, the German government has not yet succeeded in pulling the economy out of the slow lane. In fact, service sector firms slightly scaled back their business operations in August. The good news comes from manufacturing, where things have been running more smoothly for a few months now: production has increased for six straight months.

“The weakness in demand within the service sector is, according to surveyed companies, partly due to ongoing uncertainty among their clients. This aligns with the decline in incoming orders, including those from abroad. Despite lower business activity, service providers still feel confident enough to raise their prices. Compared to the previous month, price hikes were noticeably stronger. On the one hand, this reflects higher costs being passed on; on the other, some firms likely managed to slightly improve their profit margins in August. The relatively solid pricing power suggests that companies aren’t yet in a critical situation.

“The rise in costs faced by service firms is, according to some survey participants, linked to wages, which appear to be climbing sharply despite the weak economic backdrop. In fact, official statistics show that collectively bargained hourly wages rose by an average of 5% year-on-year in July. The shortage of skilled labour, driven by demographic trends, remains a persistent challenge, despite the economic slowdown and despite advances in artificial intelligence. Against this backdrop, the weak economic environment hasn’t yet led to significant layoffs in the service sector. Employment has instead remained flat recently.”