That's at least some positive news that will shelve stagflation fears for a while. But as price pressures continue to be an issue as we get into the new year, the risks will still remain as economic conditions remain more tepid.

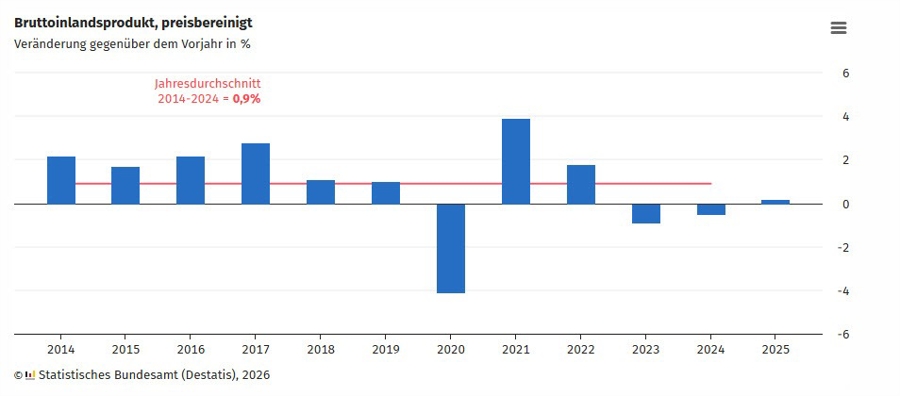

For some context, the German economy contracted in 2023 and 2024 by 0.9% and 0.5% respectively. So, this is the first positive momentum shift since 2022.

Looking at the details, the growth picture is primarily attributable to increased consumer spending by private households and the government. Meanwhile, exports declined yet again as US tariffs weighed on the sector alongside other factors such as the appreciation in the euro currency and increased competition from China.

Besides that, overall investment remains weak with the numbers here being softer in both equipment and construction than in the previous year.

The manufacturing sector also failed to get out of its rut, facing a third straight year of decline in output. That being said, at least the decline was less pronounced than in the two preceding years. The sub-sectors that suffered the most were the automotive and mechanical engineering industries. No surprises there as US tariffs were the main issue of course.

As for the construction sector, it was a tough year in general as well. Persistently high construction prices significantly hampered building construction and finishing trades in particular. Meanwhile, the services sector had a bit more of a mixed showing.

The saving grace for Germany this time was consumer spending, with both private and government consumption expenditure rising significantly last year. Households mostly spent on healthcare and mobility while spending in food and accommodation showed some declines.

The contrast says a lot about the growth balance since Germany is supposed to be the industrial backbone of Europe. So, just be wary of that.

As for the deficit ratio, Germany clocked in a 2.4% reading in 2025. So, that at least keeps below the European Stability and Growth Pact reference value of 3% - for now.