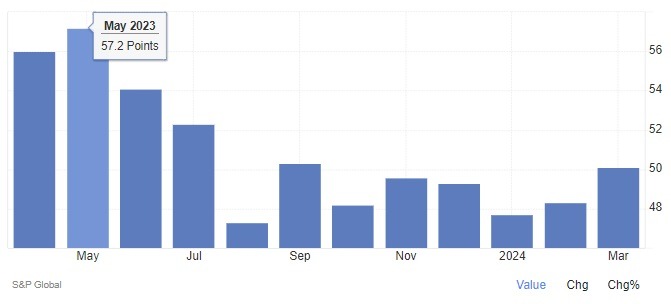

- German final services PMI 50.1 vs 49.8 expected

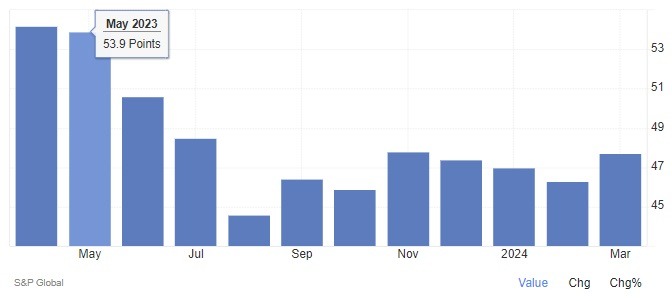

- German final composite PMI 47.7 vs 47.4 expected

Comments on the data by S&P:

“In the German services sector, a glimmer of hope emerged on the horizon in March. For the first time in six months, services activity has stabilized instead of contracting. While the acquisition of new business remains challenging, there are signs of a gradual easing in the downward trend. This trend extends to business conducted with international clients as well. Overall, the services sector is playing a stabilizing role in the broader economy. However, it is unlikely to be sufficient to avert another quarter of declining GDP at the start of this year.”

“The labour shortage continues to prevent most companies from laying off staff. In fact, employment has now seen a third consecutive month of increase, albeit with recent growth showing some moderation. It is evident that companies are operating under the assumption that future workloads will justify the current staff expansion. This fits to the brightened future outlook among service providers, with optimism reaching its highest level since the outset of 2022.”

“Costs within the service sector continue to rise, albeit at a notably slower pace compared to the previous month, hinting at a deceleration in wage growth momentum. Moreover, inflation in sales prices has declined even more sharply than cost inflation, indicating more competitive pressure among service providers and a corresponding decrease in pricing power. This is basically good news for the European Central Bank, which has recently been particularly concerned about inflation in the service sector. However, this single monthly figure will most probably not be sufficient to prompt a loosening of monetary policy in April."