UPCOMING EVENTS:

Tuesday: Canada CPI.

Wednesday: UK CPI, FOMC Policy Decision.

Thursday: SNB Policy Decision, BoE Policy Decision, US Jobless Claims.

Friday: S&P Global US PMIs.

Last week we got some more drama around the banking sector, but this time in Europe. We saw Credit Suisse (again) under stress which weighed on the risk sentiment initially, but eventually things calmed down as the SNB offered support for the bank.

For this reason, the ECB decided to go through with the 50 bps hike telegraphed in the prior weeks, but refrained to offer any future guidance as they want to see how things evolve in the next weeks.

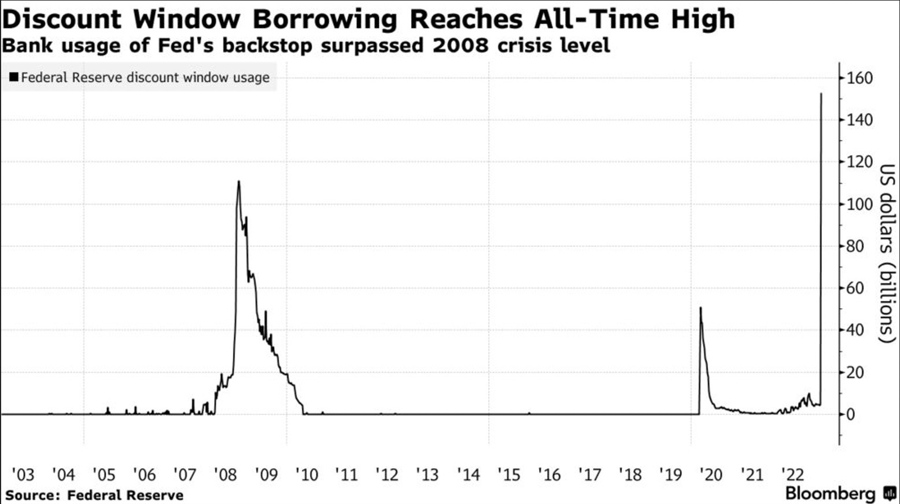

In the US, The Fed created an emergency lending facility called “Bank Term Funding Program” which lets eligible banks to take one-year loans against high quality collateral valued at face value instead of marked to market.

The Fed has also eased conditions at the Discount Window to make it more attractive for the banks in need of loans to borrow from it. The total value of loans increased the Fed’s balance sheet by roughly $300 billion dollars. Many called it QE, but it really isn’t.

Depositors are taking their money out of small banks to the “too big to fail” ones, as people know that those would get a bailout in case we get a real crisis. This is also why we got the report this weekend of midsize banks asking the FDIC to insure all deposits for two years.

The most notable mover the last week was the bond market. It’s most likely signalling that the hard landing is near and that recent events will be enough to tip the economy into recession soon and the Fed to reverse course.

Such a fast repricing reminds me of a quote from Stanley Druckenmiller where he says to “act first and research later. Markets move quickly, ideas spread fast, especially good ones, so it pays to get positioned. You can always exit if your research changes the story”.

Looking ahead I would prefer to shy away from risk assets, especially if economic data starts to worsen and, in such scenario, the US Dollar would appreciate as a safe haven, especially against the commodity currencies.

Tuesday: Canadian CPI is expected to ease to 5.4% vs. the prior 5.9% Y/Y and 0.4% vs. the prior 0.5% M/M. The Core measure is expected at 4.6% vs. the prior 5.0% Y/Y and 0.8% vs. the prior 0.3% M/M. Given that this week the market will be focused on the FOMC, we may see some defensive positioning into the announcement. So, the most likely reaction, in my opinion, would be USD/CAD appreciating faster in case the CPI misses and slower in case the CPI beats. The recent selloff in Oil prices suggests that the market is positioning for a hard landing and in such instances a commodity currency like CAD depreciates versus the US Dollar.

Wednesday: UK CPI is expected at 9.8% vs. the prior 10.1% Y/Y and 0.6% vs. the prior -0.6% M/M. The Core measure is expected at 5.8% vs. the prior 5.8% Y/Y and -0.5% vs. the prior -0.9% M/M. A beat may give the GBP some short-term strength in light of the BoE decision, but I would expect it to be faded. A miss, on the other hand, is likely to cause a faster depreciation in GBP/USD. If the banking woes in the US increase or if they indeed changed the macroeconomic picture for the worse, the USD is more likely to appreciate as a safe haven going forward.

The market prices a higher chance for the FOMC to raise interest rates by 25 bps this week. The Fed doesn’t like to surprise on the way up, so they always follow market pricing. A 50 bps hike would be a very aggressive move and would tank the markets. A pause, on the other hand, may be a weak move and bring into question the Fed’s resolve in fighting inflation. In my opinion, it’s likely that we will see the Fed raising rates by 25 bps to show its commitment to fight inflation but also to buy some time and see how things evolve in the next weeks in the banking sector and in the economic data. I also expect them to keep QT on autopilot. What the Fed will project in the Dot Plot is an even bigger question mark. In my opinion, it’s likely that they will keep it unchanged with the terminal rate at 5.00-5.25%, but I expect it to be followed by some hawkish comments like “we are data dependent and may go higher if incoming data warrants such a move”.

Thursday: The SNB is expected to choose between a 50 and 75 bps hike after the recent inflation data surprised to the upside. The current policy rate stands at 1.00%. Moreover, the recent woes regarding Credit Suisse may weigh on the central bank’s decision and probably lead to the less aggressive move.

The BoE is expected to hike by 25 bps bringing the bank rate to 4.25%. The MPC will see the UK CPI report before the vote and given the recent troubles in the banking sector in the US and fears of spill over to Europe and UK, the MPC may vote for no change in case CPI misses and a quarter-point increase in case CPI beats. It’s very likely that we will see again a split in the voting with Tenreyro and Dhingra probably voting for a rate cut.

US Jobless Claims, in my opinion, will be a very important data from now on. The reason revolves around the business sentiment around the recent banking troubles. Recent events may have hit the future outlook and may lead to more layoffs as businesses turn defensive and credit to small/mid companies may be tightened. Initial Claims are expected at 199K vs. the prior 192K, and Continuing Claims are seen at 1715K vs. the prior 1684K. I think a big jump in the data would be bad for risk sentiment.

Friday: The S&P Global US PMIs data is generally collected mid-month and released soon after. This makes this report a hot one for the week in my opinion. We may see how the events in the last weeks impacted business conditions. The Manufacturing PMI is expected at 47.6 vs. the prior 47.3. The Services PMI is expected at 50.8 vs. the prior 50.6. Finally, the Composite PMI is expected at 47.5 vs. the prior 50.1. I’m inclined to see a bearish reaction in both a miss and a beat. With the former, the signal would be that the recent events have worsened the economy, and with the latter, the Fed may keep at tightening monetary conditions.