Trump fired the head of the BLS after last month's revision-filled non-farm payrolls report and this is the first one since. The move to fire Bureau of Labor Statistics Commissioner Erika McEntarfer was obviously political and no one takes seriously Trump's accusation that she 'faked' jobs numbers.

So what now?

On the face of it, I'd imagine it would be very difficult to upend all the processes that go into making the jobs report in a month. Then again, maybe just the chill leads to a series of small efforts to make sure that nothing is 'undercounted' or that seasonal adjustements are tweaked and that's enough. Or maybe someone at the top will just take a sharpie to the numbers in a desperate attempt at self-preservation.

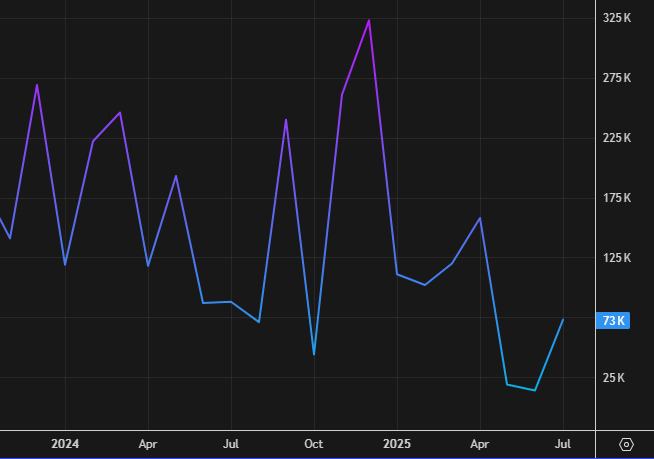

What I'm certain of is that I know the worst-case scenario: Something like 500K new jobs. The consensus is +75K and an outrageously strong report -- even if it's the usual statistical noise -- would forever-damage the report's credibility going forward. Where it starts to get tricky is how low you can go and still retain believably. Is it 200K?

I'm not sure where the market will draw the line.

The flipside would be if we get a negative number or further large downward revisions. That raises a totally different set of questions and begs for even more political interference.

That brings us back to the middle. What if it's a tad strong or a tad weak? What is the market willing to believe?

I don't think anyone has the answers and it's best not to try and be a hero.