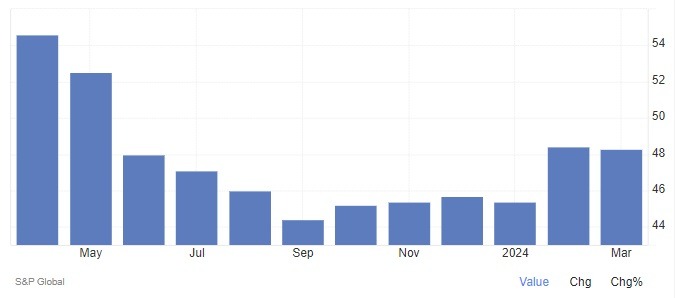

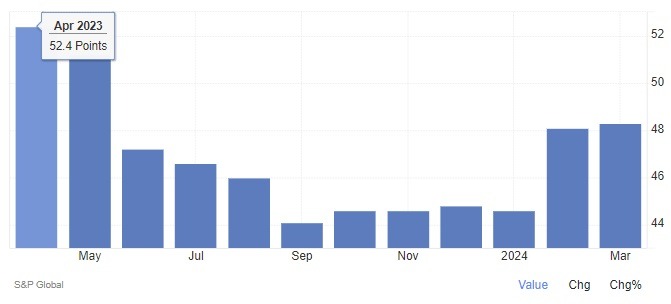

- French final services PMI: 48.3 vs 47.8 expected

- French final composite PMI: 48.3 vs 47.7 expected

Comments on the data from S&P:

"The French economy's recovery is delayed until at least Q2. Hiring activity increased, new business declined at a much slower rate than seen in Q4 and companies are more optimistic about the future – this is a good setting for the coming months. Although business activity slowed again, it was only a modest decline. According to anecdotal evidence, service providers reported weak economic conditions, high interest rates and inflation as drags on business activity."

“The global demand slump hampers French services. Surveyed service providers reported that new export business declined in March, particularly due to lower demand from Asia. If demand increases in the coming months, there is not much that stays in the way of a recovery of the French economy.”

“French service providers are optimistic about the future. Output expectations increased to their highest level in almost two years due to expectations of better economic conditions. They also mentioned hopes of increasing activity due to planned hiring.”

“Growing wages are generating inflationary pressures, however. The latest HCOB PMI figures show that the labour-intensive services sector is still dealing with increasing input and output prices due to salaries. However, the Prices Charged Index is approaching the threshold of 50 more and more. According to the HCOB Nowcast, France’s consumer price inflation is closing in on the 2% target rate."