- Prior +1.1%

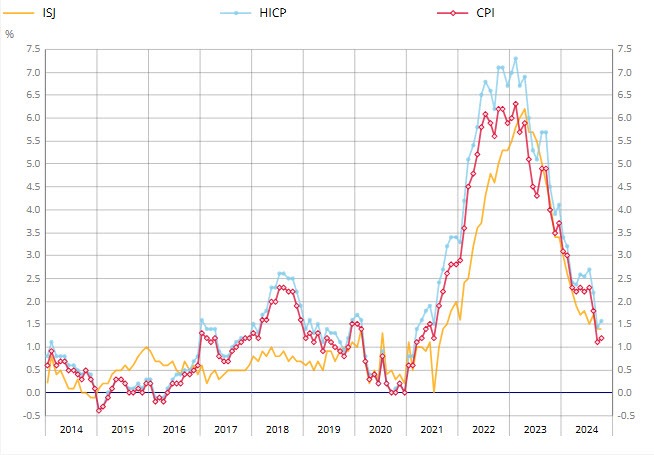

- HICP +1.6% vs +1.5% y/y prelim

- Prior +1.4%

Core annual inflation was unchanged, seen at 1.4% in October. So, that's at least one bright spot for the ECB although it is still relatively high and sticky in the likes of Germany.

Core annual inflation was unchanged, seen at 1.4% in October. So, that's at least one bright spot for the ECB although it is still relatively high and sticky in the likes of Germany.

Most Popular

Sponsored

Bitcoin bounces off $80K support! ETFs & yearly cost basis at $83K show strong demand. Traders watch for upside.

Hawaii's tourism slows, hitting small biz. Luxury travelers boost spending, but fewer visitors overall. Islands see mixed hotel performance.

US high-grade spreads hit 0.76%, tightest since Oct. AI debt sales loom, Oracle's cash flow concerns, Netflix/WBD deal add risk. Valuations high.

Data centers' $41B boom strains infrastructure funds & workers, slowing road projects. Watch construction sector valuations!

EU battery storage profits surge 15%+ with 15-min pricing; arbitrage gains up 14%. Austria/Slovakia see 20%+ boosts.

MSTR stays in Nasdaq 100 despite bitcoin focus; its $59.5B BTC stash ties its fate to crypto's volatile swings.

2026: Crypto IPOs face valuation scrutiny amid BTC volatility. Will they be durable or a fad?

Sponsored

Must Read