- Prior +0.9%

- HICP +0.7% vs +0.7% y/y prelim

- Prior +0.8%

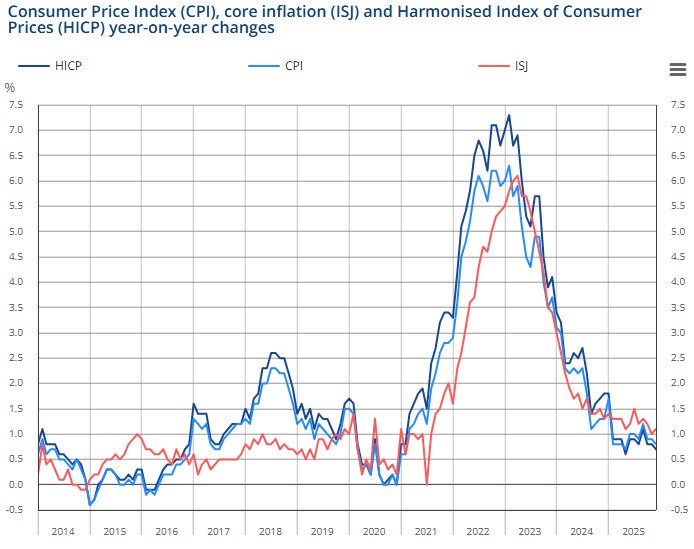

There are no changes to the initial estimates but while headline annual inflation showed a decline, core annual inflation actually reflected a marginal increase in December. The latter was seen at 1.1% in the final month of 2025, up from 1.0% in November the month before.

At the very least though, services inflation eased a little to 2.1% in ending the year. And that is down from 2.2% in November. However, food price inflation picked up in a rise to 1.7% in December - up from 1.4% previously.

The readings here aren't anything too concerning for the ECB as they are keeping well below the 2% mark, especially on core prices. So, France is one spot that policymakers can turn their attention away from - at least in terms of economic data. But as we know, France's political climate offers up another set of risks for the central bank but we'll not dive into that discourse here.

On the inflation front, the main worries right now are Germany and Spain. In particular, the former is the major concern as stagflation risks will come into the picture as we look to the year ahead.