- More from Japan PM Kishida - says a return to deflation cannot be ruled out

- Japan PM Kishida says BOJ December 'tweak' was to enhance, sustain monetary easing effects

- Citadel Securities has been fined for stock algorithm trading breaches

- The US, Japan and the Netherlands have reached agreement on chip export curbs to China

- Bitcoin dipping a little in Asia, still having a good opening to the year

- US inflation indicator data coming up on Friday - preview ICYMI

- Tokyo area CPI for January kept on surging. USD/JPY hit lower still.

- Australian Q4 PPI +0.7% q/q (vs. expected 1.7%) +5.8% y/y (expected 6.3)

- Australian Q4 export prices -0.9% q/q (prior -3.6%) & import prices +1.8% (prior 3.0%)

- New Zealand January business confidence -52.0 (prior -70.2) Activity -15.8 (prior -25.6)

- USD/JPY lower in Asia morning trade, higher Tokyo CPI giving yen a lift

- Japan data - Tokyo inflation for January 2023. Headline 4.4% y/y (prior 4.0%)

- BNZ expect a convincing boost to New Zealand business confidence in coming months

- US House Republicans considering kicking the US debt ceiling can to September 30

- Credit Suisse remain bullish AUD/USD - nominate a break above 0.7138 as the level to watch

- Oil ICYMI - EU considers capping Russian diesel price at $100 a Barrel

- Goldman Sachs Fed view: balance of risks toward further tightening, not cuts later in 2023

- South Korea follows contracting GDP with more bad news - manuf outlook ugliest in 2 yrs

- Trade ideas thread - Friday, 27 January 2023

- Forexlive Americas FX news wrap: US GDP beats estimates

The CPI rate in Japan’s capital Tokyo hit a 42-year high in January. The inflation data from Tokyo is published about 3 weeks ahead of nationwide CPI and serves as a guide to what to expect. The Bank of Japan have insisted, over and over, that current high levels of inflation in Japan are transitory only, driven by cost-push factors. Indeed, the BOJ forecasts that inflation will begin to slow from around September/October this year. Other DM central banks, of course, also held onto the ‘transitory’ explanation only to experience skyrocketing inflation and being forced into rapid rate hike cycles. Some reduction in easy BOJ policy are expected by many in the market from some time after April, when Bank of Japan Governor Kuroda’s term expires and a new Governor is appointed. If today’s jump in Tokyo inflation is reflected in the nationwide data to come it’ll increase the pressure even more on the BOJ to dial back its easy monetary policy.

Elsewhere from the region today we had data showing an improvement in the ANZ New Zealand business survey. Its still showing deep pessimism just not so much as in the previous survey.

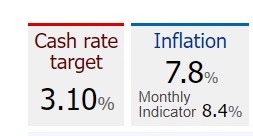

We also had Australian PPI data for Q4, which fell back a little from Q3 and is an encouraging sign that perhaps inflation has peaked. Earlier in the week the Australian Bureau of Statistics released the latest quarterly and monthly CPI data, which scaled new highs to 7.8% and 8.4% respectively. A slowing would be very welcome but both are a long, long way above the top end of the Reserve Bank of Australia’s 2 to 3% target band for inflation. The Bank meet on February 7 and it would seem they’d be ignoring their mandate were they not to raise the cash rate from its current 3.1% level. Pic is from the front page of the RBA website and shows how far behind the RBA cash rate is: