- No Federal Reserve speakers scheduled for the holiday Monday, but BoE's Mann is speaking

- Australian Q2 Business Inventory data were much weaker than expected

- China Caixin services PMI for August 55.0 (expected 54.0)

- Australian data: Q3 Business Inventories +0.3% q/q (expected +1.6%)

- Australia headline monthly inflation gauge -0.5% m/m (prior +1.2%) but core higher

- PBOC sets USD/ CNY reference rate for today at 6.8998 (vs. estimate at 6.9153)

- New Zealand data - ANZ commodity price index -3.3% in August (vs. prior -2.2%)

- Japan August Services PMI 49.5 (prior 50.3)

- Biden is considering moves to restrict US investment in Chinese technology companies

- US equity index futures near flat in Sunday evening (Chicago time) trade

- Australian Services PMI August: 50.2 (prior 50.9)

- South Korea says it'll intervene in FX markets if needed

- Australian Construction PMI for August stays in contraction at 47.9 (from July 45.3)

- BOJ USD/JPY intervention - the level to watch is 142 to 143

- Over the weekend Sweden & Finland announced up to (around) USD33bn in energy guarantees

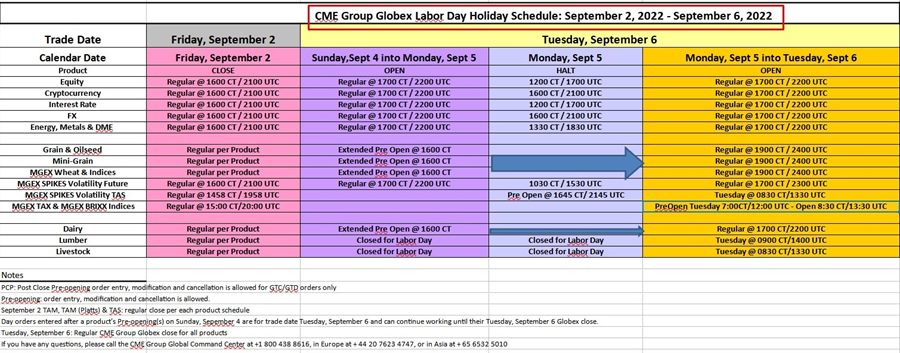

- Here are the US CME futures markets hours this Labor Day long weekend

- OPEC+ likely to hold production steady at this week's meeting, Russia doesn’t want a cut

- The weekend Forex report for the week starting September 4, 2022: The USD remains the king

- German energy price subsidies as Russia cuts NordStream gas exports to Europe indefinitely

- Trade ideas thread - Monday, 5 September 2022

- Monday morning open levels - indicative forex prices - 05 September 2022

- Germany unveils €65 billion package to subsidize energy prices

- Bed, Bath & Beyond CFO falls from skyscraper to his death

- Russell analysis and recap of trade ideas

- AUD traders - RBA monetary policy meeting coming up Tuesday 6 September 2022 - preview

- Do you have the FEAR OF SUCCESS when you trade?

- The G7 is taking a huge risk with the Russia oil price cap

- MUFG trade of the week: Long USD/JPY

There was news and data from the weekend and today’s session but the net impact on forex markets has been a little subdued with both Canada and the US on holiday on Monday.

USD/JPY traded a little higher but has not approached its post (Goldilocks) NFP high. US yields are still firm and the BOJ is showing no sign of relenting on its ultra-loose monetary policy, helping support USD/JPY. There is some speculation that a rapid move into 142-143 would trigger Bank of Japan intervention (see the bullet point above for more).

Elsewhere the USD is touch higher too against EUR, AUD, GBP and others.

CME hours for the long weekend: