- Goldman Sachs wary of China's economic bounce - cite weak property sector weighing

- Key China economic hub Guangdong Province sets its 2023 GDP growth target at 6%

- More on the nomination of Kazuo Ueda as the next Bank of Japan Governor

- RBNZ inflation expectations (2 yr) dribble lower, NZD/USD too

- RBNZ New Zealand inflation expectations 2yr 3.3% (prior 3.6%)

- US President Biden is set to name Brainard as his top economic adviser

- BoE +25bp rate hike coming in March, then a pause

- Japan GDP disappointing - new BOJ Gov will find it difficult to start any normalization.

- PBOC sets USD/ CNY central rate at 6.8136 (vs. estimate at 6.8138)

- Japan's economy minister urges sustainable wage growth

- Australia NAB Business Confidence for January 6 (prior -1)

- ANZ revise fed funds forecast higher. Expect +75bp this year, cite strong US economy

- Japan Q4 2022 GDP (preliminary) 0.2% q/q, missing estimate of 0.5%

- Australia monthly consumer confidence (February) -6.9% (vs. prior 5%)

- ICYMI - US to sell another 26 mn barrels of crude oil from the Strategic Petroleum Reserve

- US Fed 'insider' Timiraos is warning of a potential upside surprise in January US CPI data

- Tentative signs of meeting between US Sec State Blinken & China FM Wang Yi later this week

- Australia weekly consumer confidence fell 5.5 points w/w to its lowest since April 2020

- ICYMI: BlackRock cut Japan stocks to “underweight” citing concern over a BOJ policy change

- Hong Kong central bank bought HKD to defend the peg, first time since November 2022

- ICYMI - senior Democrats want stricter limits on stock buybacks

- New Zealand data - January Food Price Index +1.7% m/m (prior +1.1%)

- Goldman Sachs on US Jan. CPI: "potential to interrupt the more relaxed inflation outlook"

- Trade ideas thread - Tuesday, 14 February 2023

- Strong start to the new trading week in the US stock market

- Forexlive Americas FX news wrap: Inflation? No worries

US January CPI data is due at 8.30am US Eastern time, 1330 GMT. There are previews, and links to others, in the bullets above.

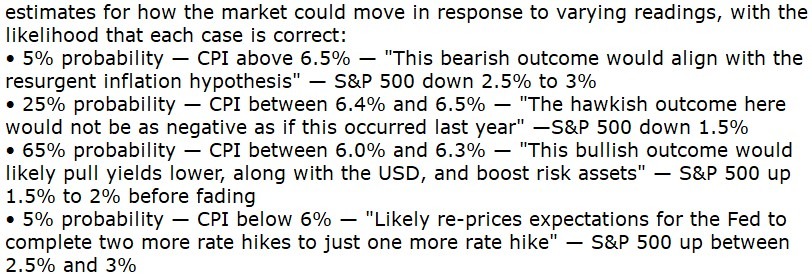

JP Morgan have outlined scenarios as follows:

As for Asia today it was mainly subdued in small sorts of ranges (yen excepted!). NZD/USD had a quick drop on the release of Reserve Bank of New Zealand inflation expectations data that showed lower is expected ahead, in the key 2-year time horizon (see bullets above).

USD/JPY lost ground through the session, back towards 132.00. Q4 GDP data was released, a disappointment and food for thought for those who are gung-ho on expecting an imminent Bank of Japan accommodation reduction. The Bank of Japan expects the current level of inflation to fall from around September / October unless there are sustainable wage rises ahead, which seems unlikely, and the data today indicate the economy will struggle if policy accommodation is wound back much at all.

In other data:

- in Australia the Westpac-Melbourne Institute Unemployment Expectations index jumped 10.6% to 119.4 points in February, an 18 month-high (higher index reads mean more consumers expect unemployment to rise)

- also in Australia, the weekly and monthly consumer sentiment surveys were appallingly weak, the weekly dropped back to a level last seen at the beginning of the pandemic

- Australia again, the NAB business survey showed conditions and confidence both rose, and are sitting above long-run averages. There was little reduction in inflation pressure shown in the results, purchase costs growth picked up to 3.2% in quarterly terms (from 2.6%) while labour costs growth rose to 2.7% (from 2.1%).

The New Zealand government declared a National State of Emergency on Tuesday before Cyclone Gabrielle hits in full.

Federal Reserve System Vice Chair Lael Brainard looks set to make the jump to the White House. Its expected she’ll be named as US President Biden’s top economic adviser, replacing the departing Brian Deese as head of Biden's National Economic Council.

Asian equity markets:

Japan’s Nikkei 225 +0.6%

China’s Shanghai Composite more or less flat

Hong Kong’s Hang Seng +0.1%

South Korea’s KOSPI +0.7%

Australia’s S&P/ASX 200 +0.2%