- China's onshore and offshore yuan have hit their highest this month

- Toyota says wage negotiations with its labour union will continue.

- Warren Buffett’s annual letter to shareholders will be published on Saturday 24 February

- Bank of England Monetary Policy Committee member Dhingra speaking Wednesday

- Fed speakers on Wednesday include Bostic and Bowman - its not all about the FOMC minutes!

- China air traveller numbers +44.6% y/y in January

- Bank of Japan could keep policy ultra-easy well beyond April

- US politics - House Republicans are now expecting a government shut down

- Bezos sells additional $2.3bn in Amazon stock. Has sold total of $8.4bn in past 2 weeks.

- PBOC sets USD/ CNY mid-point today at 7.1030 (vs. estimate at 7.1877)

- Australian data - Q4 2023 Wage Price Index +0.9% q/q (vs. expected +0.9%)

- China fund manager makes bullish comments on Chinese sharemarkets

- Japan data: January exports beat expectations while imports came in lower than expected

- China's hefty rate cut is expected to provide an only marginal net stimulus to the economy

- Australian data: Westpac Leading Index (January) -0.08% (prior -0.04%)

- Reuters Tankan report for February shows a drop for services, slump for manufacturing

- Amazon will replace Walgreens Boots Alliance in the Dow Jones Industrial Average

- New Zealand data - Q4 PPI rises

- UBS has raised it year-end S&P 500 target to 5,400

- Forexlive Americas FX news wrap: Canadian CPI cools, US dollar does a round trip

- US stocks close the day in the red to start the holiday shortened week

- Trade ideas thread - Wednesday, 21 February, insightful charts, technical analysis, ideas

Ranges for major FX rates were relatively small for the session here with many traders content to wait it out until the Federal Open Market Committee (FOMC) minutes due at 1900 GMT/1400 US Eastern time.

While news flow was light we did have data from the region.

Japan's exports rose more than expected in January, driven by U.S.-bound shipments of cars and car parts and Chinese demand for chip-making equipment. Imports fell more than expected. Improved exports do paint an improved picture for Japan’s economy. On the flip side we had the Reuters Tankan report for February which showed sentiment in the services sector slipping back a little while remaining net positive, but sentiment for manufacturing plunged back to net pessimism for the first time in 10 months.

From Australia, it was wages data for Q4 of 2023. The wage price index rose 0.9% in the quarter, matching market forecasts. This rise came after a record +1.3% in the previous quarter. Pay growth picked up to 4.2% y/y, from 4.1% in Q3, and to its highest since early 2009 and just above market expectations of 4.1%. Wage growth at 4.2% is just above the latest y/y CPI at 4.1%. Analysts at RBC Capital Markets say the wages report could add a little to the RBA's assessment of upside inflationary risks.

AUD and NZD are both up around 20 or so points from session lows.

Gold was one way traffic higher.

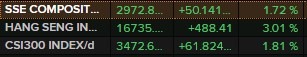

Hong Kong and Chinese mainland stocks added to their Tuesday gains today: