- Federal Reserve Bank of Atlanta President Bostic is speaking on Thursday

- European Central Bank President Lagarde will be speaking again on Thursday

- Swiss National Bank Chairman Thomas Jordan will be speaking Thursday

- UBS has raised its forecast for economic growth in China this year to 4.6%, from 4.4%

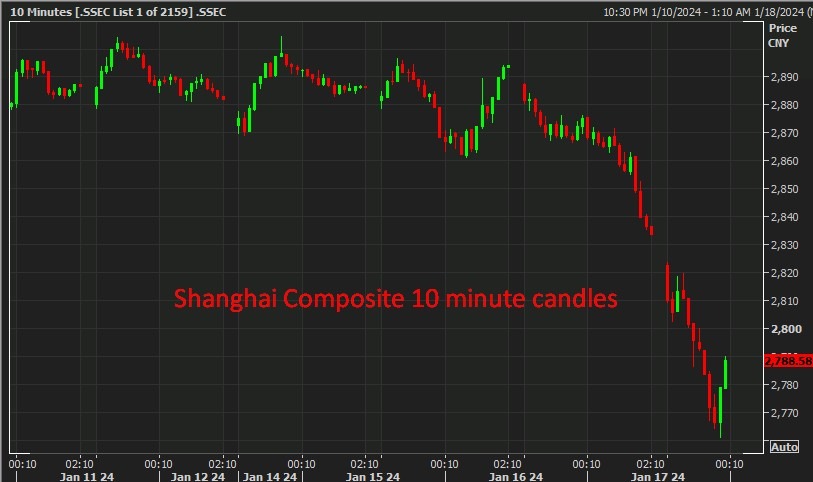

- China's stock market rout continues - Shanghai Composite hits a four year low

- Reports say that Pakistan has attacked terrorists inside Iran

- Reuters poll: 21 of 85 economists predict first ECB rate cut in April, 38 say June

- Morgan Stanley says paradigm shift (pro- Bitcoin and CBDCs) threaten US dollar’s dominance

- PBOC sets USD/ CNY reference rate for today at 7.1174 (vs. estimate at 7.1976)

- Goldman Sachs CEO says inflation will stay higher than expected

- Australian dollar dropped after the December jobs report showed a large loss

- Australia Dec. Employment -65.1K (expected +17.6K) Unemployment rate 3.9% (exp 3.9%)

- US military conducted another round of strikes on Houthi targets in Yemen

- UK RICS data rose to -30 in December from -41 in November

- US President Biden will speak on the US economy on Thursday, 18 January 2024 @ 2pm ET

- Japan November Machinery orders collapse -4.9% m/m (vs. expected -0.8%)

- Another ECB official has joined the push back against those pricing in imminent rate cuts

- HSBC predicts mixed performance for US dollar: strength to persist

- The rapid drop in the yen likely to be met by some sort of attempt at verbal intervention

- Forexlive Americas FX news wrap 17 Jan: Better retail sales push the USD/Yields higher.

- New Zealand December Food Price Index -0.1% m/m (prior -0.2%)

- Oil - private survey of inventory shows headline build vs. draw that was expected

- Trade ideas thread - Thursday, 18 January, insightful charts, technical analysis, ideas

Stocks in China continued under pressure, with the Shanghai Composite hitting a four year low. As I post its showing some bounce with chatter that China’s ’National Team’ (China's state-backed funds) were in buying. By pretty much any measure Chinese equities are trading cheap, perhaps the Team is getting a bargain. We were given the heads up to something like this earlier in the week:

The data calendar today featured the Australian jobs report for December. There are details in the bullets above but, in brief:

there was a loss of around 65K jobs in the month, the second-largest loss since the 1993 recession

part-time positions rose by 41,400 this was offset by the loss of 106,600 full-time position

the unemployment rate stayed steady at 3.9% due to a fall in the participation rate from its record high in November

At the margin, a slowing labour market (if that is the implication that can be drawn from one month’s data) should take some wage pressure out of drivers of inflation in Australia. The RBA next meet on February 5 and 6. At least one bank’s analyst team have dropped their forecast for a hike at this meeting after today’s data.

AUD/USD dipped after the labour market report but soon recovered to track higher alongside a weaker US dollar pretty much across the major’s board.

- Global political developments continue to escalate:

- For the 4th time in a week, US struck Houthi military sites in Yemen

- Pakistan conducted attacks inside Iran on camps of Baloch terrorists, with drone and missile strikes. Iran said several missiles hit a border village as well.